You get into an accident and go to the emergency room. Out of pocket is the amount you have to pay out of pocket for covered medical expenses.

How A Deductible Works For Health Insurance

How A Deductible Works For Health Insurance

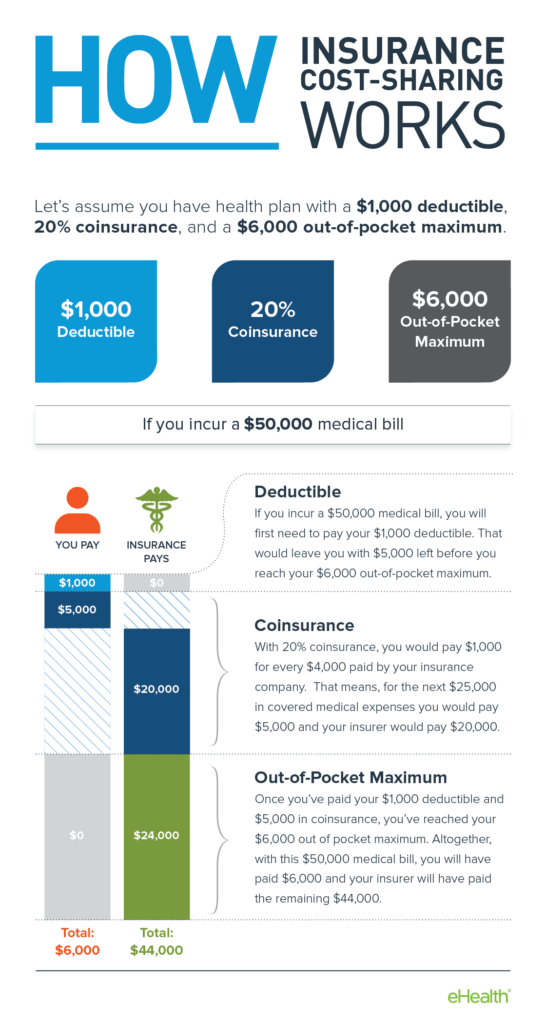

Has a health plan with a 2500 deductible 20 coinsurance and a 4000 out-of-pocket maximum.

What is out of pocket in health insurance with example. Anzeige Compare 50 Health Insurance Plans Designed for Expatriates. Get a Free Quote. Suppose your out-of-pocket maximum is 6000 your deductible is 4500 and your coinsurance is 40.

These can be various charges which are as prescription fees deductibles co-payments and coinsurance. The insurance company also sets a maximum amount that youll have for medical expenses on your own called an out-of-pocket maximum. Heres an example.

Your out-of-pocket maximum may read differently depending on what type of health insurance plan you have. Insuranceopedia Explains Out-of-Pocket Limit. Anzeige Compare Top Expat Health Insurance In Switzerland.

- Applicable For Foreign Citizens Only - Not for Local citizens students. For example if your policy has a 10000 out of pocket max then the most you would pay for covered medical expenses would be 10000 plus your deductible for that year regardless of how much your actual medical expenses were. Heres an example of how out-of-pocket maximums work.

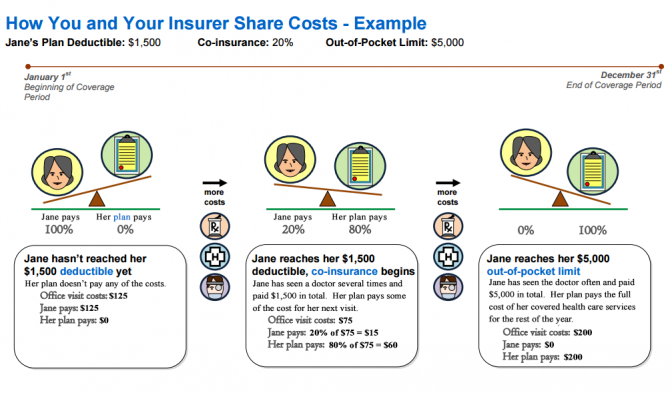

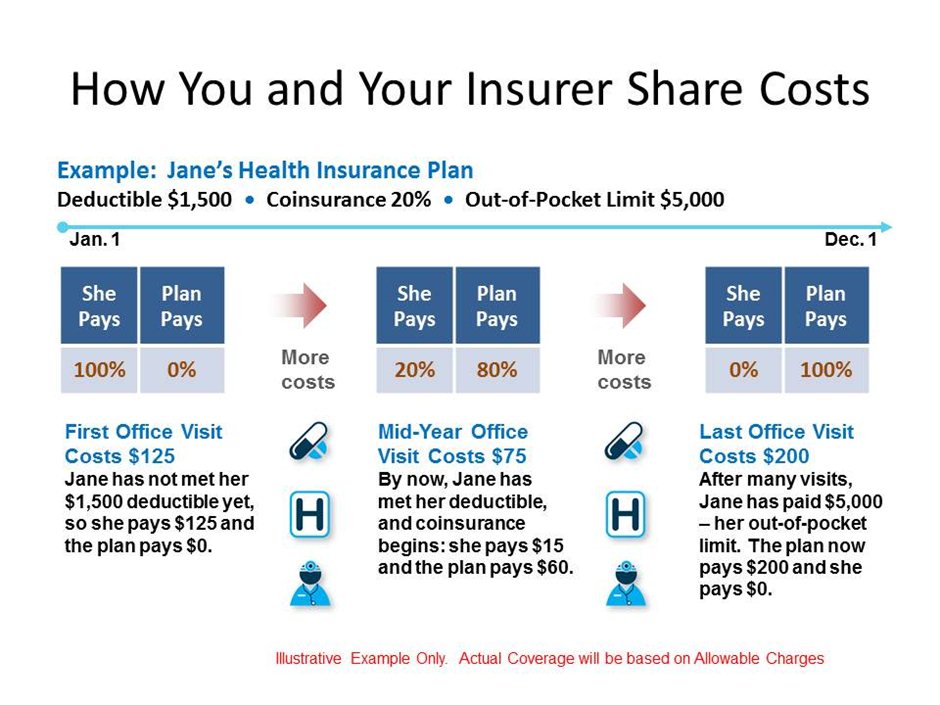

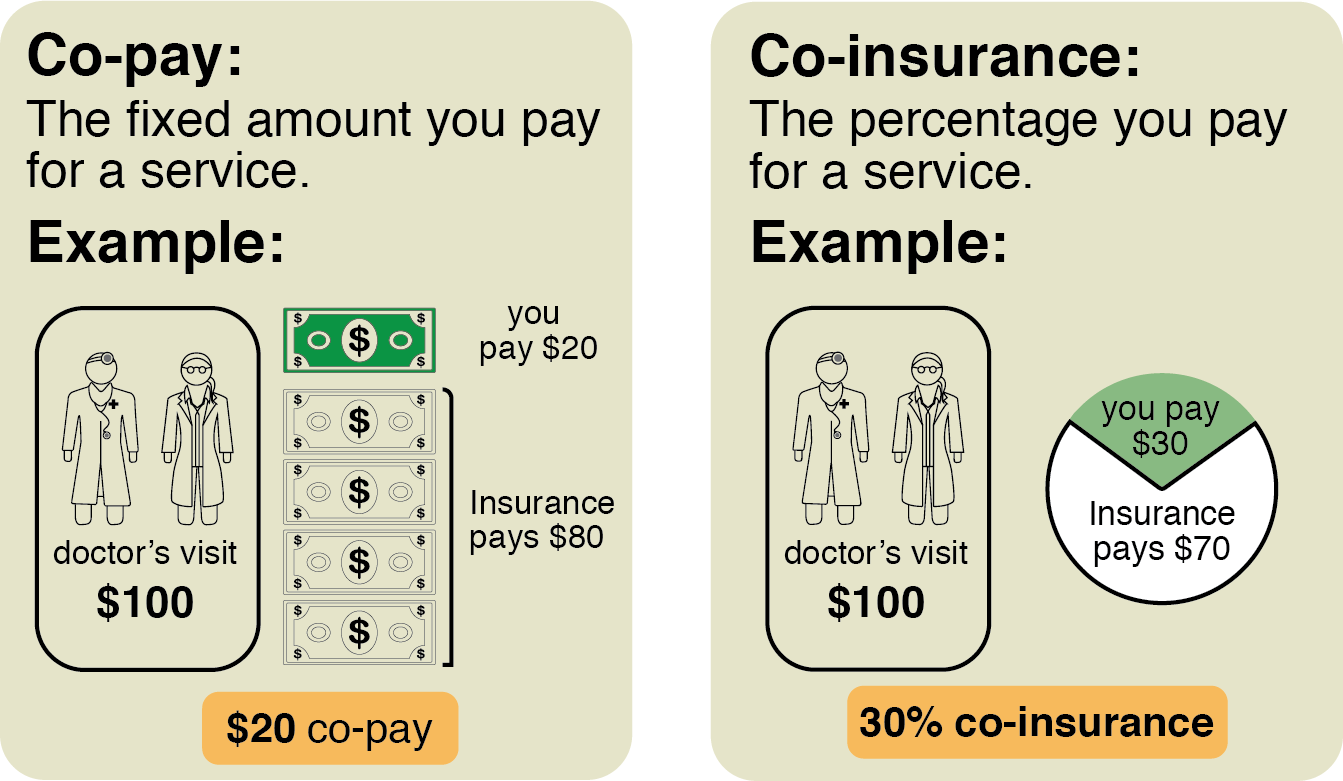

She sees her regular doctor and a number of. Anzeige Compare 50 Health Insurance Plans Designed for Expatriates. A copayment is an out of pocket payment that you make towards typical medical costs like doctors office visits or an emergency room visit.

Many health insurance plans cover prescriptions but the amount you pay. Your insurance policy has a 1000 deductible and an out-of-pocket maximum of 4500. If you have covered surgery that costs.

For example your policy may include a 5000 out-of-pocket maximum whenever you see a medical provider within your network and also include a separate 5000 out-of-pocket limit for out-of-network medical costs. Medical services that are covered by your insurance plan can still have an out-of-pocket component. An example of out-of-pocket health expenses is prescription medications.

Get a Free Quote. - Applicable For Foreign Citizens Only - Not for Local citizens students. For example an individual plan may have an out-of-pocket maximum of 5000 for that one person while a plan with two people may have a 5000 out-of-pocket maximum per person.

This means they would pay 2000 as a deductible which leaves 8000 in remaining expenses. Heres an example of how an out-of-pocket maximum might work depending on the health plan. - Free Quote - Fast Secure - 5 Star Service - Top Providers.

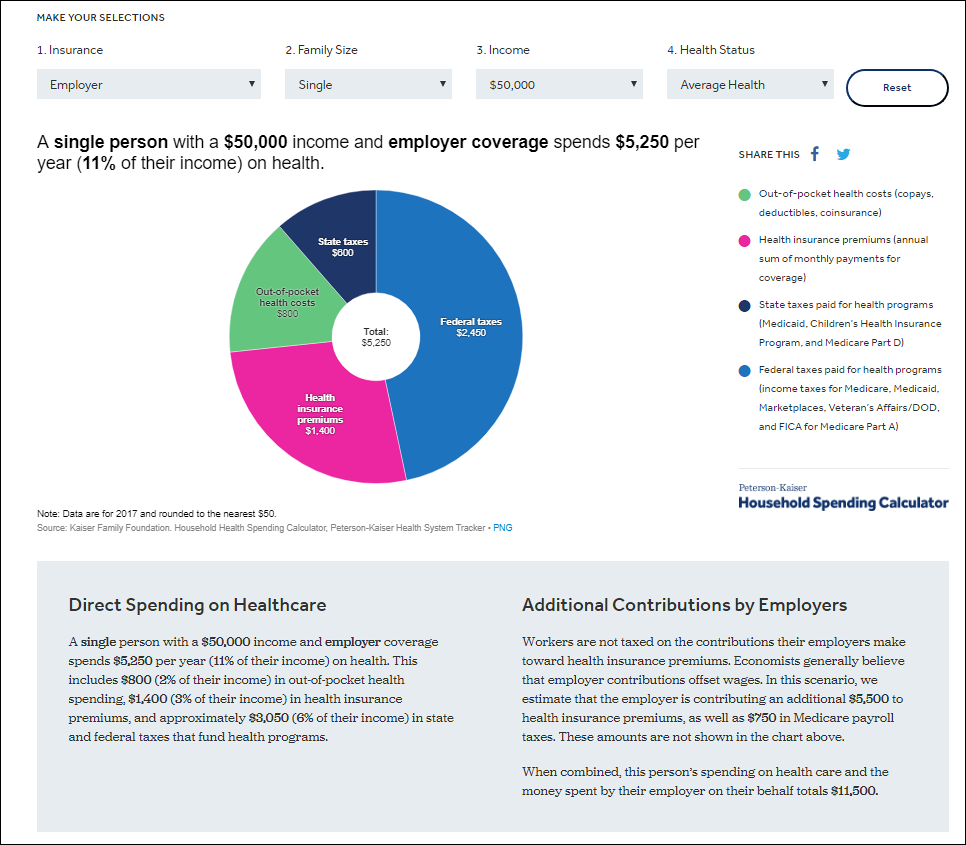

In order to minimize your healthcare costs you need to look at your total annual spending for healthcare which includes not just your monthly premiums but also all the money you pay towards deductibles copayments coinsurance and other out-of-pocket expenses. For example a policyholder has a health insurance policy with a deductible of 2000 30 percent coinsurance and out-of-pocket limit of 4000. In health insurance your out-of-pocket expenses include deductibles coinsurance copays and any services that are not covered by your health plan.

Health insurance out of pocket expenses are the expenses that are not covered by the medical policy or the health insurer and these costs need to be borne by the policyholder only. Within the context of healthcare out-of-pocket often refers to out-of-pocket costs specifically medical expenses which you pay by yourself instead of expenses where your insurance foots the bill. An out of pocket maximum is the set amount of money you will have to pay in a year on covered medical costs.

At the start of her plan year she has an unexpected illness. You pay the 1000 deductible to the hospital before your insurance company will pay for any of the covered services you need. They undergo a covered treatment costing 10000.

Get the Best Quote and Save 30 Today. What are out-of-pocket expenses. Out-of-pocket expenses are paid in addition to your monthly premium for health insurance.

Out Of Pocket Costs For Health Insurance

Out Of Pocket Costs For Health Insurance

5 Key Definitions In Health Plans Medcost

5 Key Definitions In Health Plans Medcost

What Is An Out Of Pocket Maximum Bluecrossmn

What Is An Out Of Pocket Maximum Bluecrossmn

How Do Health Insurance Deductibles Work

How Do Health Insurance Deductibles Work

How Health Insurance Works Money Matters

How Health Insurance Works Money Matters

Out Of Pocket Costs What You Need To Know

Out Of Pocket Costs What You Need To Know

Decoding Doctor S Office Deductibles Blue Cross And Blue Shield Of Montana

Decoding Doctor S Office Deductibles Blue Cross And Blue Shield Of Montana

Out Of Pocket Expense Meaning Examples How It Works

Out Of Pocket Expense Meaning Examples How It Works

How Health Insurance Works Money Matters

How Health Insurance Works Money Matters

3 Things To Consider When Signing Up For Health Insurance

3 Things To Consider When Signing Up For Health Insurance

The Real Cost Of Health Care Interactive Calculator Estimates Both Direct And Hidden Household Spending Kff

The Real Cost Of Health Care Interactive Calculator Estimates Both Direct And Hidden Household Spending Kff

What Does Out Of Pocket Mean In Health Insurance

What Does Out Of Pocket Mean In Health Insurance

Definitions And Meanings Of Health Care And Health Insurance Terms

Definitions And Meanings Of Health Care And Health Insurance Terms

Health Insurance Basics How To Understand Coverage

Health Insurance Basics How To Understand Coverage

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.