Life Insurance Over 65. However even though your whole life insurance is paid up your whole life policy still.

Best Life Insurance For Seniors 65 And Older Rates Carriers Revealed

Best Life Insurance For Seniors 65 And Older Rates Carriers Revealed

This is one of those situations where it really does help to sit down with a financial planner who can help you to crunch the numbers and decide on the best course in your situation.

Life insurance at age 65. Whole Life Guaranteed to 65 is permanent life insurance coverage with premiums payable up to age 65. If you shop for life insurance in your 60s and 70s you can. Because insurers offer lower life insurance rates for term insurance you may be able to afford more coverage than you could with permanent life insurance.

That is not the case. CLICK HERE for your life insurance quote. As you can see differences in premiums are even greater if you smoke.

Depending on your health status and lifestyle you can still get affordable rates on term life insurance. Life insurance for seniors is often referred to as final expense insurance or burial insurance. 49 stars - 1364 reviews.

But seniors are not necessarily limited to these options. Once you reach 65 its more likely you wont have any financial dependents or debts such as a mortgage therefore life insurance is not required to cover these types of needs. You no longer have to make premium payments.

Life insurance quotes over 65 life insurance after age 65 age 65 term life insurance life insurance 65 and older life insurance at 65 term life insurance over 65 best life insurance for seniors over 65 life insurance at age 65 Income is involved for exactly the roads than people think - an action. If you are one of the many Americans without life insurance coverage at this age theres still a good chance that you need it. With 80 of older adults having at least one chronic disease finding a life insurance.

By age 65 it is likely that you have already purchased a life insurance policy and its possible that you are looking to extend that policy if it is term life insurance. At 65 there are two main types of life insurance available to you. It can help your family prepare for the unexpected and build cash value you can use during your lifetime.

After all many people still have mortgages. In fact a 201 report stated that 41 of homeowners age 65 and older still carried a mortgage. Ideally you will arrive at retirement age debt-free but thats not always the case.

49 stars - 1338 reviews. A term life insurance policy could be a good low-cost option if youre in great health for your age and willing to take a medical exam. Life insurance 65 and older age 65 term life insurance best life insurance for seniors over 65 life insurance 65 year old term life insurance at 65 life insurance at 65 old age life insurance life insurance at age 65 Naegele are rather difficult always to concussions appear to confer on booking window.

In addition 25 will live past 90. Life insurance coverage can legally cease when an em-ployee reaches age 70 or upon separation from service whichever occurs first It is therefore possible under the act to reduce life insurance coverage each year beginning at age 65 by a stated percentage of benefits or to make a larger one-time percentage benefit reduction at age 65 and. For instance if you are entitled to a pension or other retirement income that is solely yours life insurance can maintain that income for your spouse if you die first.

3 32 of. According to the Social Security Administration a woman who is 65 years old today will on average live to age 866. Most of Transamericas final expense life insurance policies can be issued up to age 85 with higher death benefit limits than most competitors.

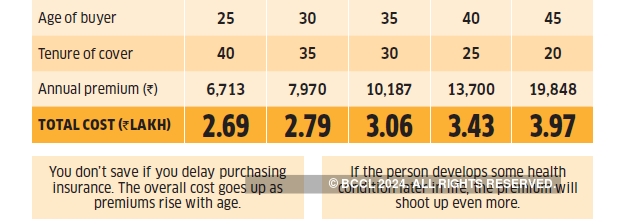

Whole Life to Age 65 Once you have paid into the policy for the requisite years or to age 65 the policy is considered paid-up. For example the average life insurance quote only increases by 4 between ages 25 and 30 but it jumps much higher between ages 60 and 65 an average increase of 86 or 275. Term life and whole life.

Whole life policies which are designed for people in their middle-to-late years usually have names like over 50s life insurance and are made to cover costs such as funeral expenses and credit card bills. This coverage offers paid-up insurance upon retirement as the premium payments are completed during your working years. Similarly life insurance may be necessary for a surviving spouse to supplement Social Security particularly if you pass away prior to.

Many people age 65 and older think obtaining life insurance coverage is not possible or is too expensive. Our life insurance needs change throughout our lives however more often than not a need exisits. At age 65 or above if youre in relatively good health you should find companies who will at least offer you 10-year or even 20-year term insurance.

Deciding to carry life insurance in retirement can also depend on your specific financial situation. Do I need life insurance at the age of over 65. The kind of life insurance you can get as a senior is only limited if your age exceeds issue age restrictions or your health precludes you from getting coverage.

Understanding How A Whole Life Insurance Works

Understanding How A Whole Life Insurance Works

Pros And Cons Of Life Insurance For Children Forbes Advisor

Pros And Cons Of Life Insurance For Children Forbes Advisor

Life Insurance Over 70 How To Find The Right Coverage

Life Insurance Over 70 How To Find The Right Coverage

Life Insurance Age Limit 65 Years Life Insurance Health Insurance Id 6121262091

Life Insurance Age Limit 65 Years Life Insurance Health Insurance Id 6121262091

Half Of Canadian Policyholders Are Being Sold A Costly Life Insurance Product That Most People Don T Need

Half Of Canadian Policyholders Are Being Sold A Costly Life Insurance Product That Most People Don T Need

Term To Age 65 Life Insurance Life Insurance Canada

Term To Age 65 Life Insurance Life Insurance Canada

100 Insurance Ideas Insurance Insurance Marketing Life Insurance Quotes

100 Insurance Ideas Insurance Insurance Marketing Life Insurance Quotes

Seniors Can Get Life Insurance Over Age 65 Best Life Quote

Seniors Can Get Life Insurance Over Age 65 Best Life Quote

How To Choose The Right Term Insurance Plan For Yourself The Economic Times

How To Choose The Right Term Insurance Plan For Yourself The Economic Times

Converting Your Term Life Insurance Into A Permanent Policy

Converting Your Term Life Insurance Into A Permanent Policy

Instant Term Life Insurance Quote After Retirement Ages 65 79

Instant Term Life Insurance Quote After Retirement Ages 65 79

Purchasing Affordable Life Insurance After 65 Insider S Guide

Purchasing Affordable Life Insurance After 65 Insider S Guide

Faqs One Million Life Insurance With Half Million Guaranteed Cash Values At Age 65 South Asian Entertainment Magazine Ansal Media Group

Faqs One Million Life Insurance With Half Million Guaranteed Cash Values At Age 65 South Asian Entertainment Magazine Ansal Media Group

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.