Up to 36156 Premium Tax Credits. The scale will increase to an 85 cap for anyone making over 400 of the federal poverty level or 51520 for an individual or 106000 for a family.

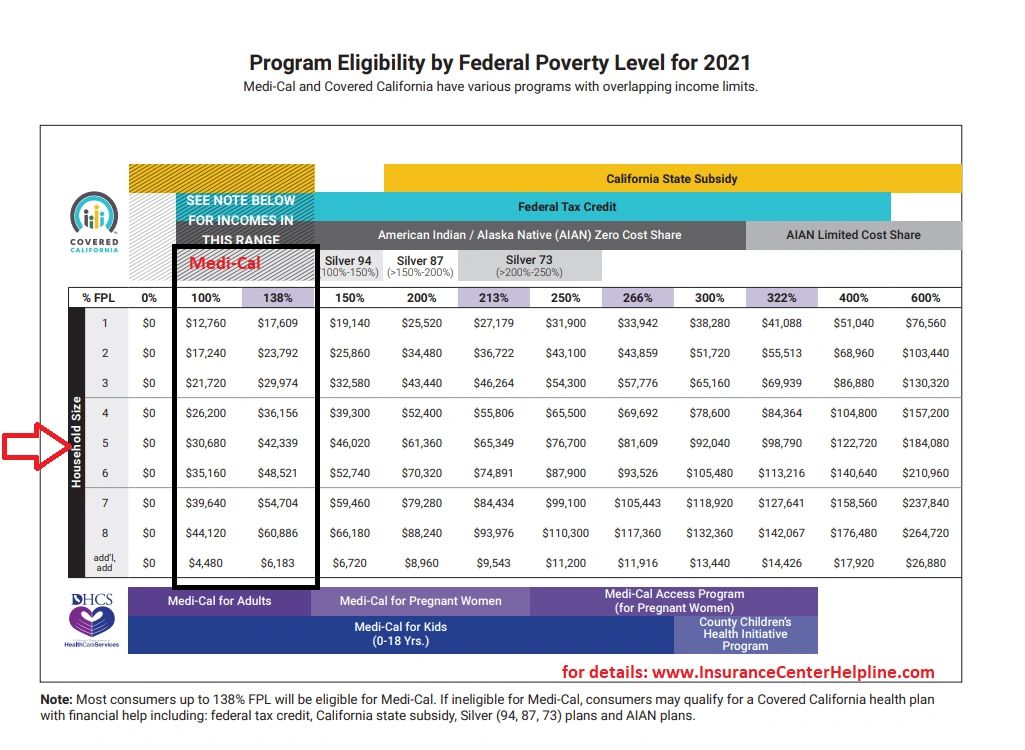

Fpl Federal Poverty Income Chart Covered Ca Subsidies Tax Credits

Fpl Federal Poverty Income Chart Covered Ca Subsidies Tax Credits

With this in mind Household income is MAGI of the head of household and spouse if filing jointly plus the AGI plus the AGI of anyone claimed as a dependent.

Obamacare income limits 2020 for family of 2. We round up and thus 17609 is 138 of the Federal Poverty Level threshold for 2020 Medicaid and CHIP. The minimum income for ObamaCare is 100 of the federal poverty level. Income under 25100 to be exact for a family of four two adults two children 20780 for a family of three and 12140 for an individual are considered poverty levels in the United States.

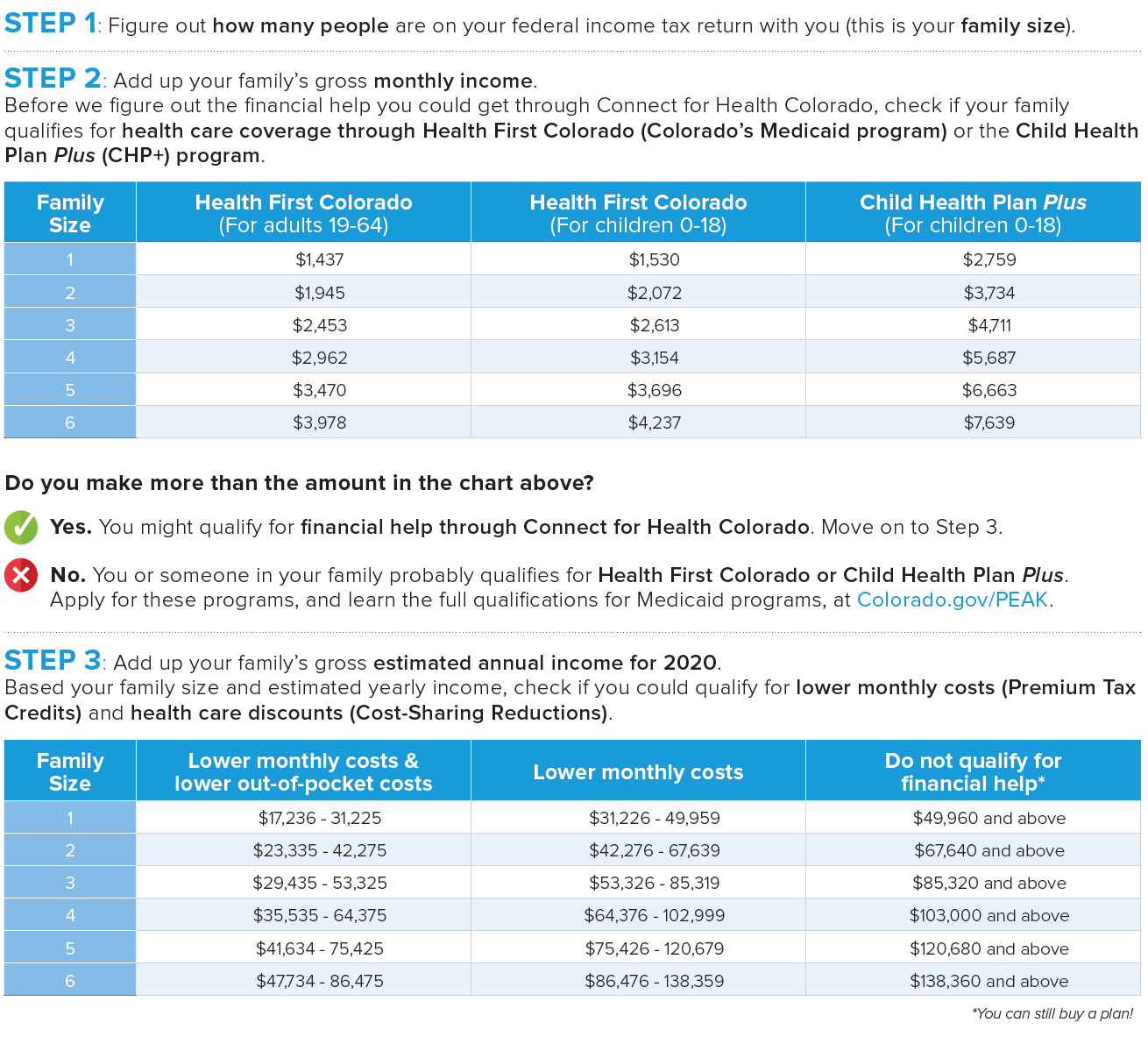

In 2021 Obamacare subsidies begin if your health plan cost is greater than 85 of your household income towards the cost of the benchmark plan or a less expensive plan the benchmark plan is the second-lowest silver plan. I Make Less Than 16753 or 34638 for a Family of Four - If your income is 138 or less of the federal poverty level you qualify for expanded Medicaid. Cost assistance is based on household income and size the people who share a plan are called a coverage family.

Between 26200- 104800 Cost Sharing Reduction. The calculator spits out 0 subsidies which is a glitch implying such applicants pay 0 to next to nothing for annual health care premiums. 6 That means Obamacare costs you zero.

Select your income range. Reply James on September 25 2020. If your income is more than 4 times the poverty level for your household size you can still buy the coverage but you will pay f.

For 2021 that is 12760-51040 for an individual and 26200- 104800 for a family of four. If anyone in your household has coverage through a job-based plan a plan they bought themselves a public program like Medicaid CHIP or Medicare or another source include them and their income on your application. Estimating your expected household income for 2021.

The types of assistance offered under the Affordable Care Act are. Family size is the number of people in your tax family. Family of Four Annual Income Medicaid.

So for example 12760 x 138 1760880. The Maximum Income You qualify for the premium subsidy only if your modified adjusted gross income MAGI is at 400 FPL or below. Individual Annual Income.

You can check the federal poverty level guidelines each year to figure out what the minimum income level is. You may qualify for a premium subsidy AND a cost share reduction if your yearly income is between. If you fall within this income range and you cant get Medicaid from your state heres what happens.

For 2020 your out-of-pocket maximum can be no more than 8150 for an individual plan and 16300 for a family plan before marketplace subsidies. Please note that in states that expanded Medicaid those making under 138. Savings are based on your income estimate for the year you want coverage not last years Use our income calculator to make your best estimate.

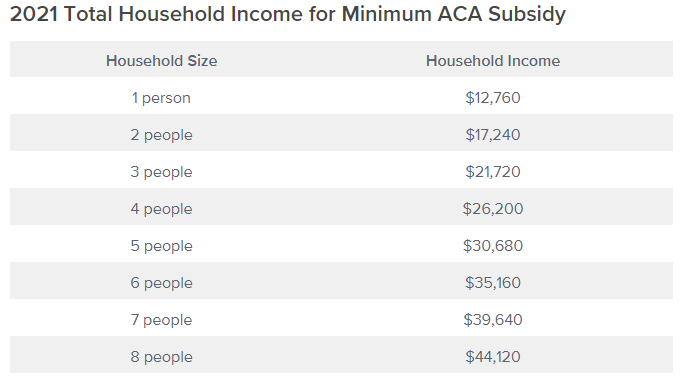

Family of 2 for 2020 is between 17240 68960 although if you are the low end you may qualify for Medicaid depending on your state. Subsidy Cutoff by Household Size 2020. But many states state didnt expand Medicaid.

Marketplace savings are based on total household income not the income of only household members who need insurance. The dollar amount of this changes every year but for 2020 it is 12490 for an individual and 25750 for a family of four. See Stay Off the ACA Premium Subsidy Cliff.

Until we update this take the guideline dollar amount below multiply by 138 and then round up. Here are the limits for 2020 plans for individuals and families. There has never been a general income limit for ACAObamacare.

ObamaCare Cost Assistance To get assistance under the Affordable Care Act you must earn between 100 400 of the poverty level. Household Size Minimum Income 100 Federal Poverty Level Maximum Income 400 Federal Poverty Level. It is my understanding that if your income is above the 400 FPL 67640 for a family of two in 2020 then there is no subsidy available.

It depends on how much you earn. You may qualify for a 2020 premium subsidy if your yearly income is between. If your MAGI goes above 400 FPL even by 1 you lose all the subsidy.

The methodology is the same for all FPL percentages. For 2020 your maximum deductible is the same as the out-of-pocket maximum. You can probably start with your households adjusted gross income and update it for expected changes.

Your income affects the price you pay for the coverage. Household Size 1 2 3 4 5 6.

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

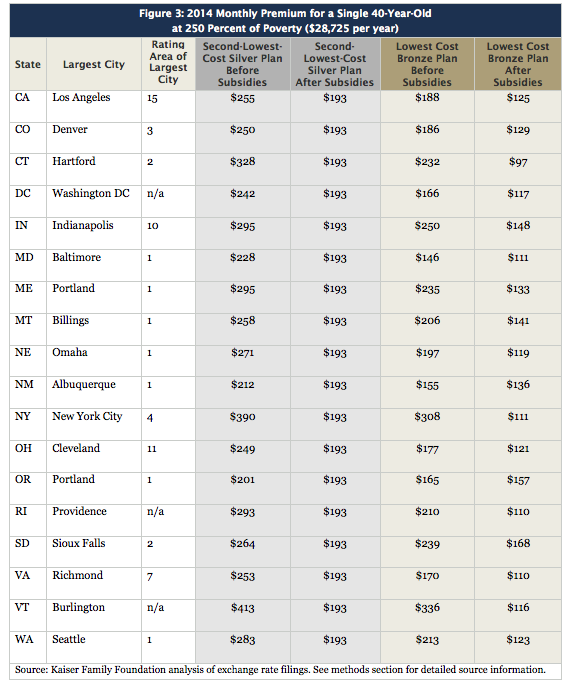

How The Affordable Care Act Is About To Become More Expensive Mygovcost Government Cost Calculator

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

What Are The 2021 Federal Poverty Levels Independent Health Agents

What Are The 2021 Federal Poverty Levels Independent Health Agents

New Tax Credit And Eligibility Charts For 2020 Released

New Tax Credit And Eligibility Charts For 2020 Released

2021 Obamacare Subsidy Calculator Healthinsurance Org

2021 Obamacare Subsidy Calculator Healthinsurance Org

Health Insurance Marketplace Calculator Kff

Health Insurance Marketplace Calculator Kff

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

Are You Eligible For A Subsidy

Are You Eligible For A Subsidy

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

What Is The Maximum Income For Obamacare Subsidies In Year 2021

What Is The Maximum Income For Obamacare Subsidies In Year 2021

Subsidy Calculator Are You Eligible For A Subsidy Ehealth

Subsidy Calculator Are You Eligible For A Subsidy Ehealth

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.