Should you include the extra 300-per-week Pandemic Unemployment Compensation PUC as part of your household income for Covered California. If any information is incorrect call Covered California right away at 1- 800-300-1506.

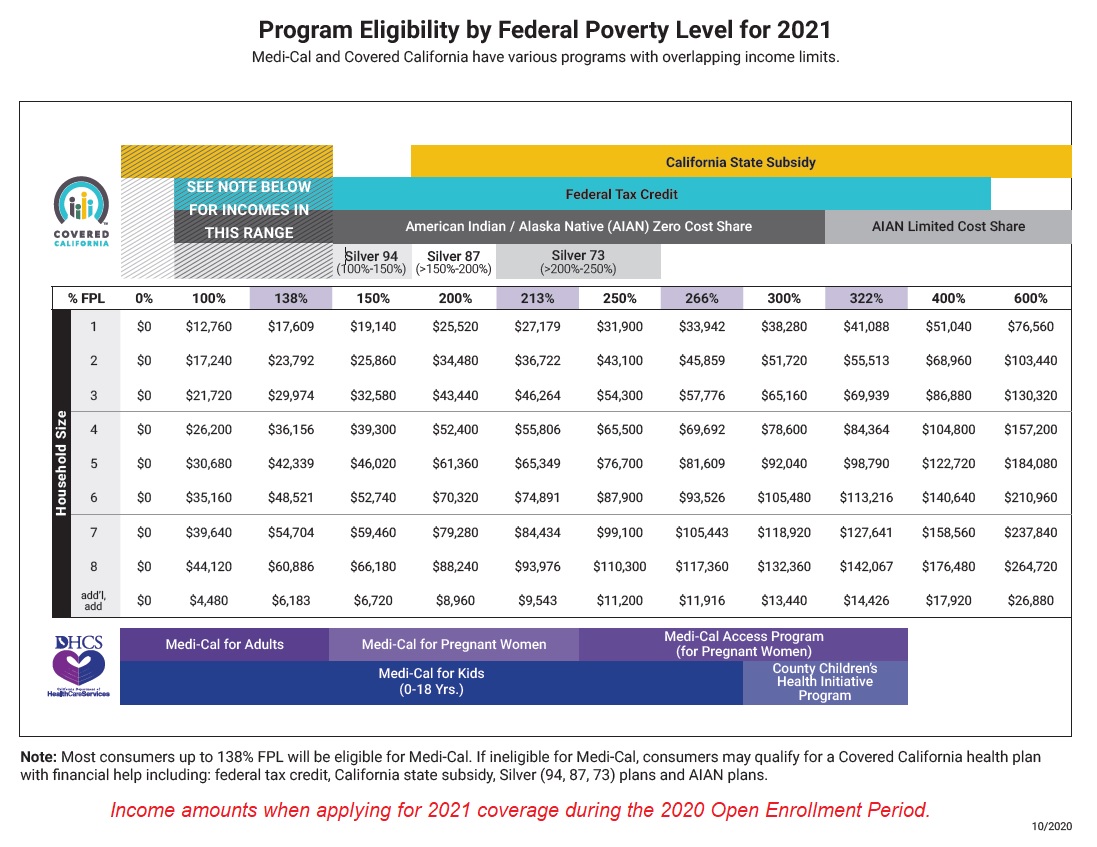

Fpl Federal Poverty Income Chart Covered Ca Subsidies Tax Credits

Fpl Federal Poverty Income Chart Covered Ca Subsidies Tax Credits

Reporting Income OCTOBER 2016 WWWCONSUMERSUNIONORG How to Report Your Income When You Apply for Financial Help from Covered California for 2017.

How to update income covered california. Can anyone get Covered California. At any time if Covered California asks you to provide documents that verify your income you must do so by the date listed on your notice. Individuals currently covered on the Exchange may have already received a consent for verification request.

Covered California is a free service from the state of California that connects Californians with brand-name health insurance under the Patient Protection and Affordable Care Act. All unemployment benefits including the extra 300 per week PUC payment are included in your taxable gross income and Modified Adjusted Gross Income. Then add or subtract any income changes you expect in the next year.

Its the only place where you can get financial help when you. Medicare clients can change their Medicare health plan and prescription drug coverage which will take effect January 1 2014. If you are uncertain about your income figures it is suggested you contact your CPA or tax preparer to receive advice on how to report your most accurate income.

Be on company letterhead or state the name of the company. Covered California Sends Notices for Consent Income and Tax Attestation. If you dont already have an online account we recommend that you create one.

People who have a health plan through Covered California currently will have to report a change within 30 days if they start getting these additional unemployment benefits. Be no older than 45 days from the date received by Covered California. People with Medicare can call 1-800-MEDICARE or visit wwwmedicaregov for plan information.

If the person is satisfied with their current plan they do not need to do anything. This allows Covered California to verify the taxpayers income. It must contain the persons first and last name income amount year and employer name if applicable.

Are you a Covered California member. May 06 2017 by Wendy Barnett. Covered CA notices are always important to read but if the recent notice sent out to certain enrollees is ignored members may.

On the home page of your online account select Report a Change. If you dont have access to your Covered California account yet you can create an account with your own username and password and link it to your already existing account. Remember as your health insurance agent we are.

To report changes call Covered California at 800 300-1506 or log in to your online account. Have you received a recent letter from Covered California. You can report a change on your Covered California account by logging into your account and clicking on the Report a Change button.

Include the following. Things like household size income and where you live can all have an impact on th. Be signed by the employer.

Dont forget to update your account. Below you will find the most frequently asked questions for current and potential Medi-Cal coverage recipients. You are required to report a change to Covered California within 30 days if your income changes enough to impact your assistance.

In order to be eligible for assistance through Covered California you must meet an income requirement. Click the Edit button next to the section that you want to change like contact information or household income. Add any foreign income Social Security benefits and interest that are tax-exempt.

To update your income or information safely and securely you can log in to your Covered California online account. You can also find a Licensed Insurance Agent Certified Enrollment Counselor or county eligibility worker who can provide free assistance in your area. In order to qualify for federal tax credits or a subsidy in California you must make between 0.

If you do not find an answer to your question please contact your local county office from our County Listings page or email us at Medi-Cal Contact Us. The employer statement must. You can start by using your adjusted gross income AGI from your most recent federal income tax return located on line 8b on the Form 1040.

First call or visit your local county Medi-Cal office to report your change s Then if you or any member of your household is eligible for a Covered CA plan call Covered CA to confirm andor update your plan selection. If so make sure to open it and read it right away.

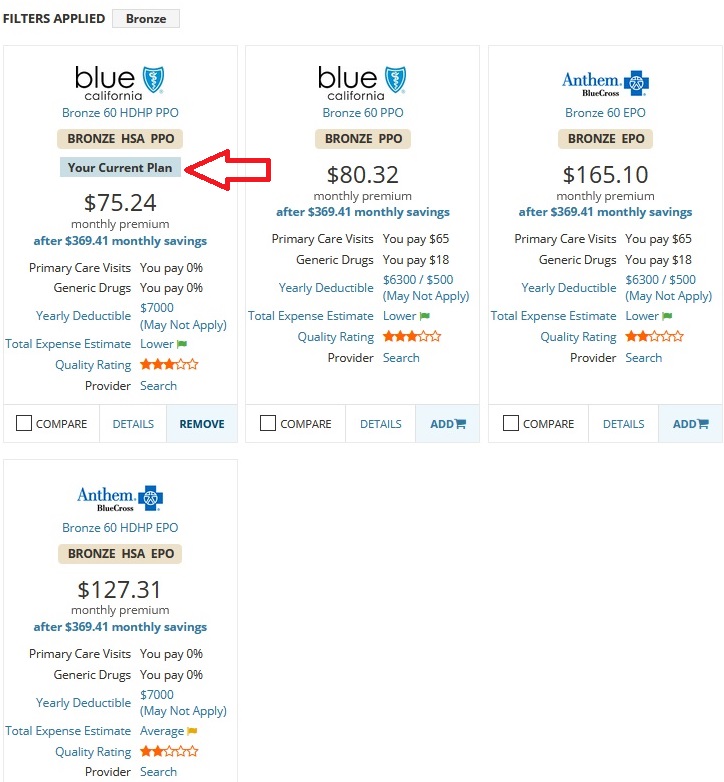

Reporting Changes Yourself Health For California Insurance Center

Reporting Changes Yourself Health For California Insurance Center

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

2021 Covered California Renewal And Open Enrollment Changes

2021 Covered California Renewal And Open Enrollment Changes

2021 Covered California Renewal And Open Enrollment Changes

2021 Covered California Renewal And Open Enrollment Changes

2021 Covered California Renewal And Open Enrollment Changes

2021 Covered California Renewal And Open Enrollment Changes

Reporting Changes Yourself Health For California Insurance Center

Reporting Changes Yourself Health For California Insurance Center

Covered California Updates Income Reporting Former Foster Youth

Covered California Updates Income Reporting Former Foster Youth

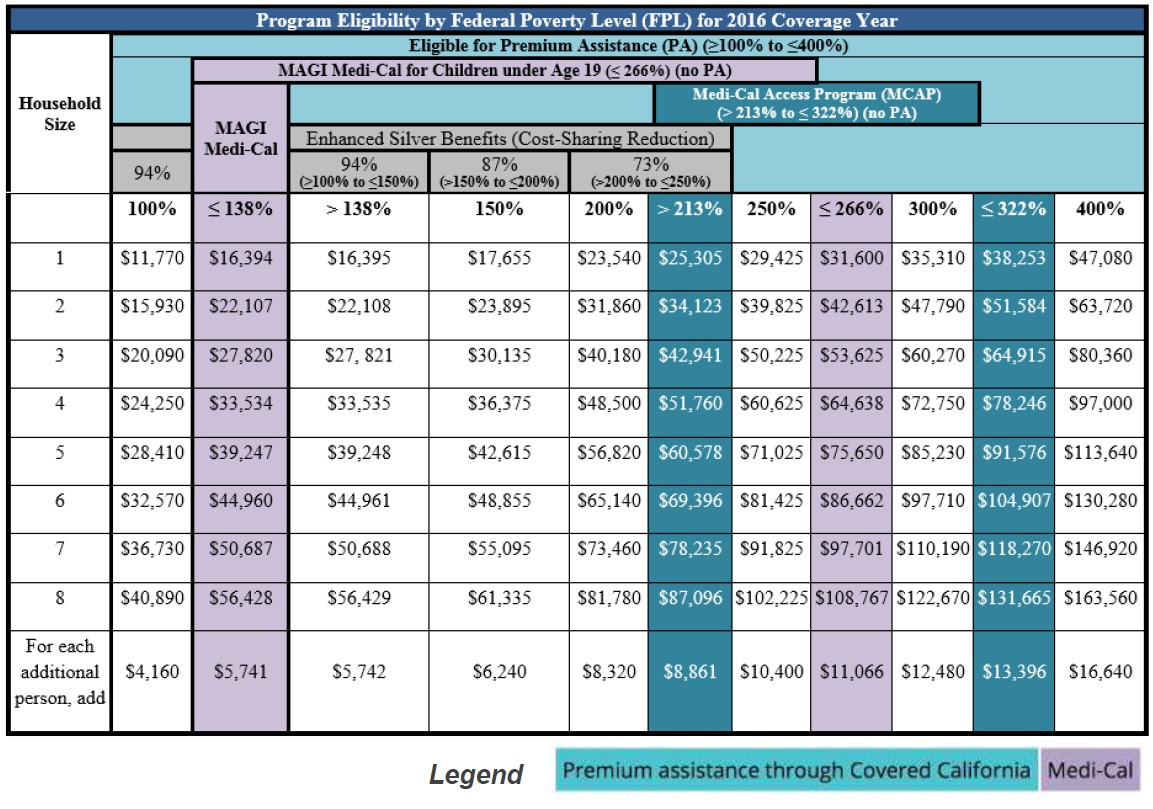

Https Hbex Coveredca Com Toolkit Renewal Toolkit Downloads 2016 Income Guidelines Pdf

Covered California Q A Covered California Archives

Covered California Q A Covered California Archives

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

Covered California Income Limits Explained

Covered California Income Limits Explained

New California Policies Make Huge Difference Increasing New Signups During Covered Californias Open Enrollment By 41 Percent

New California Policies Make Huge Difference Increasing New Signups During Covered Californias Open Enrollment By 41 Percent

How To Get The Most 2018 Covered California Tax Credit

How To Get The Most 2018 Covered California Tax Credit

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.