Youre 18 or over there are some exceptions if youre 16 to 17 youre under State Pension. Like SSI this program does not count all of your assets.

Https Hbex Coveredca Com Toolkit Renewal Toolkit Downloads 2016 Income Guidelines Pdf

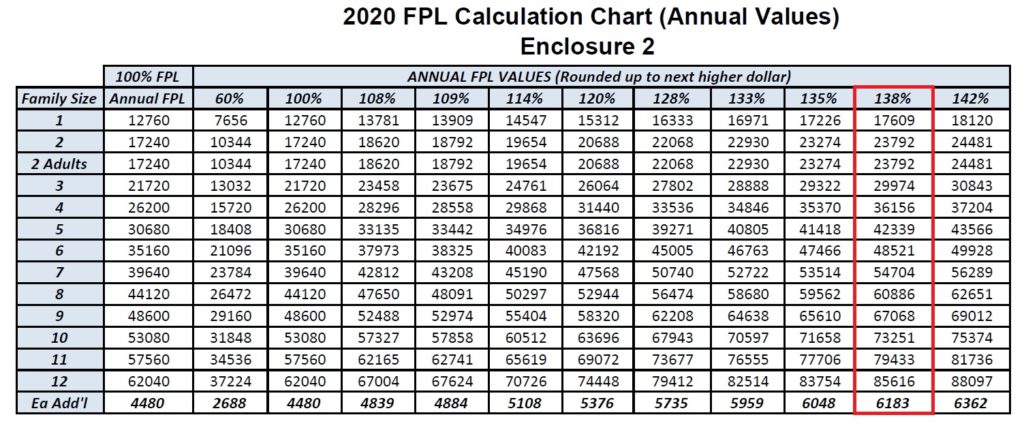

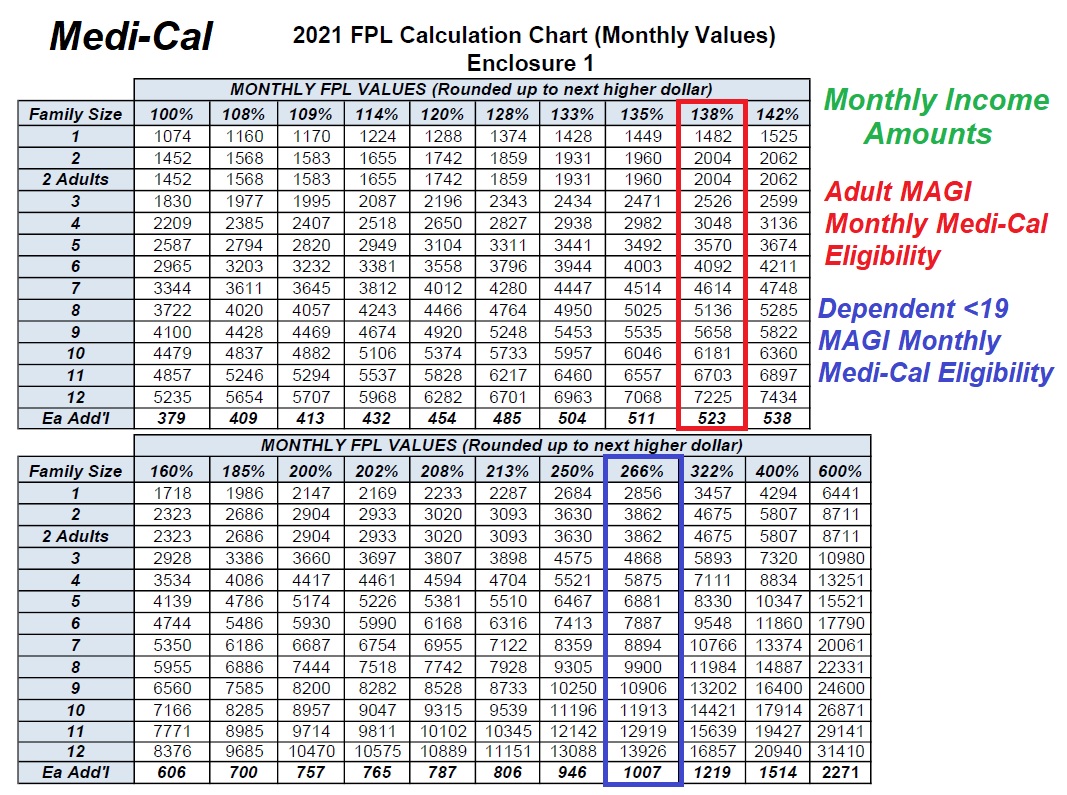

M edi-Cal 2020 Monthly Income Amounts What has not change is the upper income limit of 400 percent for the federal Advance Premium Tax Credits.

Medical ca income limits. Covered California listed the single adult Medi-Cal annual income level 138 of FPL at 17237 and for a two-adult household at 23226. Medical card holders may also be exempt from paying school transport charges and State exam fees in publicly-funded second-level schools. You may be able to get Universal Credit if.

Under the guidance of the California Department of Health Care Services the Medi-Cal fee-for-service program aims to provide health care services to about 13 million Medi-Cal beneficiaries. Nursing Home No income limit. If the individual or household is below 138 of the FPL they.

The Medi-Cal fee-for-service program adjudicates both Medi-Cal and associated health care program claims. You may qualify for no-cost or low-cost Medi-Cal and may be able to switch plans if you currently. In a skilled nursing or intermediate care home.

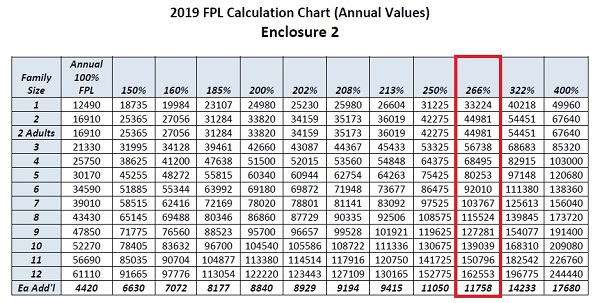

It is still at 49960 while the Medi-Cal chart based on the federal poverty level is 51040. This will let you know if you might qualify for a medical card or GP visit card. Level of Care Required.

I If you are 65 and your income is too high to qualify for SSI you may still be eligible for Medi-Cal if. It is based on basic income and expenses information. Based on your income you may qualify for tax credits when you enroll in health insurance in the state of California.

You can also get Medi-Cal if you are. Youre on a low income or out of work. If you are 65 blind or disabled and on SSI you are automatically covered by Medi-Cal.

You can also find answers about the Affordable Care Act ACA and access general health information and resources unrelated to Medi-Cal. Level of Care Required. Medicare is an earned benefit.

2000 for applicant 130380 for non-applicant. Medi-Cal is a need-based program with limited amount of income and resources a person has that determines eligibility. A full assessment is carried out later in the application process.

Have less than 1481 in countable monthly income for. For example payslip proof of social welfare payment childcare costs etc. A parent or caretaker relative of.

For a single adult applying through Covered California the monthly income must be greater than 138 of the Federal Poverty Level 1397 monthly 16754 annually in order to qualify for private health insurance with the premium tax credit subsidy. Nursing Home No income limit. The DHCS 2020 FPL income chart lists a higher amount of 17609 for a single adult and 23792 for two adults.

Ualif for no - cost or low t M edi Cal ov rage under the new 2021 income limits. Medical card holders pay the Universal Social Charge on their income if it is over the exemption limit but there is a reduced rate. Institutional Nursing Home Medicaid No income limit.

12 rows Monthly Income Annual Income. Aged and Disabled Federal Poverty Level Program ADFPLP. Or Medi-Cal Beneficiary Medi-Cal income levels have.

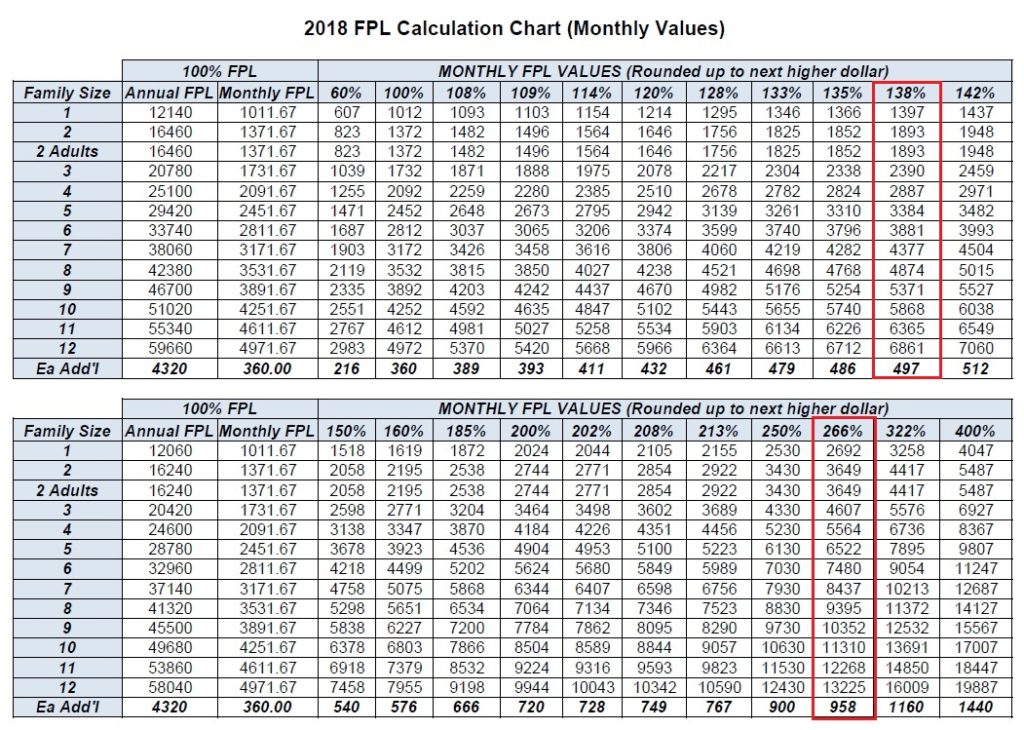

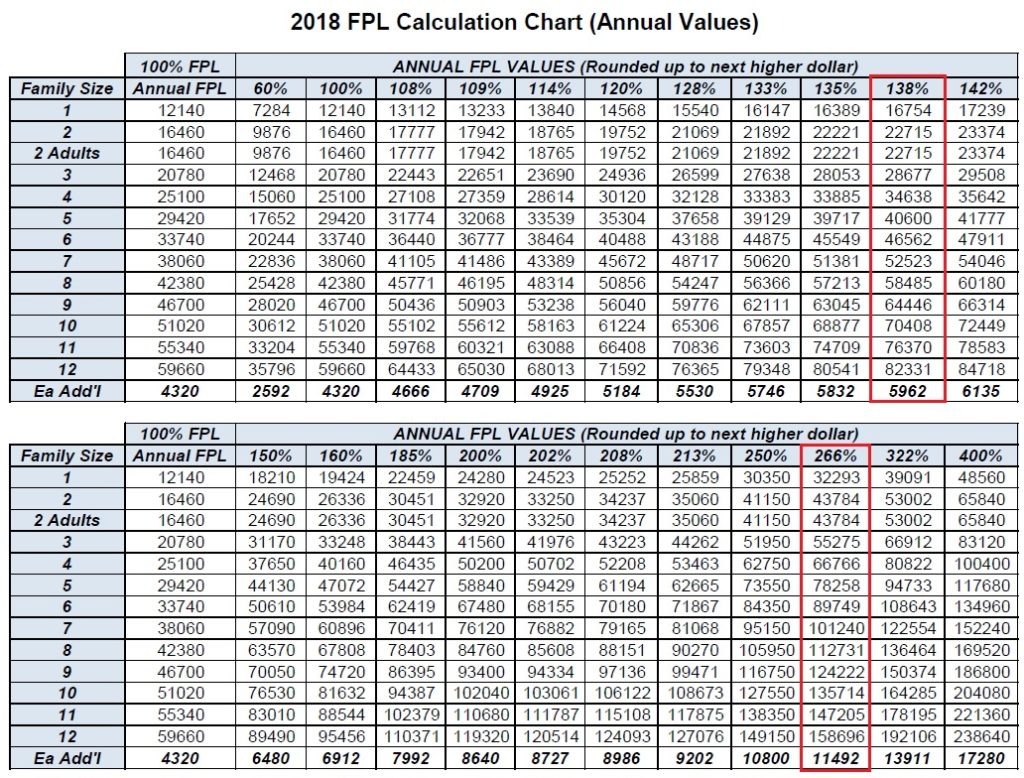

For 2018 the income limits are 1242 per month for a single person and 1682 per month. Ave Medi-Cal with a Share of Cost. You meet the Community based Medi-Cal.

On refugee status for a limited time depending how long you have been in the United States. Level of Care Required. Covered California Eligibility.

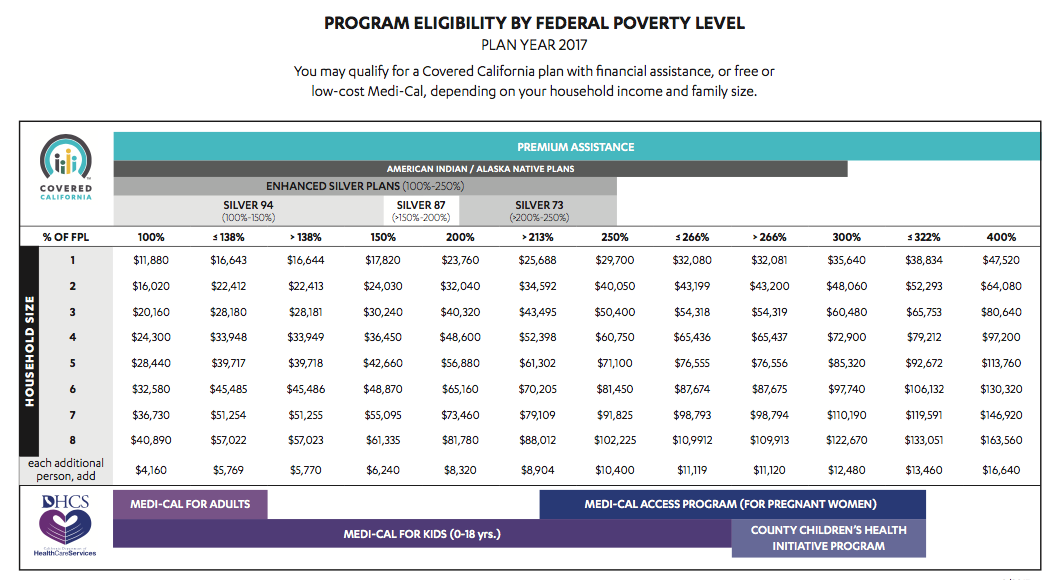

Medi-Cal for Adults up to 138 FPL Medi-Cal for Children up to 266 FPL Medi-Cal for Pregnant Women up to 213 FPL MCAP over 213322 FPL CCHIP over 266322 FPL The shaded columns display 2021 FPL values according to the Department of Health Care Services see annual values on page 5 which administers the Medi-Cal program. Welcome to the Medi-Cal Provider Home. Find out if you qualify as a Medi-Cal beneficiary how to enroll in Medi-Cal and learn about available programs for children with special medical conditions and seniors needing personal care.

The IRS uses the federal poverty levels for determining the subsidy when people file their taxes. Be either aged 65 or disabled meet Social Securitys definition of disability even if your disability is. ADFPLP program was reinstated in 2001 by the State of California in order to provide Medi-Cal coverage to elderly and disabled persons who meet SSIs resource limits but have a higher income than SSI limits.

Covered California uses FPL limits. Have less than 2000 in assets 3000 for a couple. For this you will need to upload documents showing income and expenses.

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

Medi Cal Income Levels For 2020

Medi Cal Income Levels For 2020

Medi Cal Income Levels For 2020

Medi Cal Income Levels For 2020

2018 Medi Cal Monthly Income Eligibility Chart

2018 Medi Cal Monthly Income Eligibility Chart

2019 Medi Cal Program Income Levels For Families And Individuals

2019 Medi Cal Program Income Levels For Families And Individuals

Covered California Versus Medi Cal Pfeifer Insurance Brokers

Covered California Versus Medi Cal Pfeifer Insurance Brokers

Covered California Health Insurance Income Guidelines

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

Fpl Federal Poverty Income Chart Covered Ca Subsidies Tax Credits

Fpl Federal Poverty Income Chart Covered Ca Subsidies Tax Credits

How Do I Know If I Qualify For Covered California Or Medi Cal

How Do I Know If I Qualify For Covered California Or Medi Cal

What Are Income Limits That Will Allow You To Qualify For Medi Cal Or Coveredca Health Plans Income Health Plan How To Plan

What Are Income Limits That Will Allow You To Qualify For Medi Cal Or Coveredca Health Plans Income Health Plan How To Plan

2021 Medi Cal Income Amounts Modest Increase Fpl

2021 Medi Cal Income Amounts Modest Increase Fpl

2018 Medi Cal Monthly Income Eligibility Chart

2018 Medi Cal Monthly Income Eligibility Chart

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.