What is the average cost of employer-sponsored health insurance. Health insurance for employers.

Different Types Of Health Insurance Plans

Different Types Of Health Insurance Plans

Anthem Blue Cross and Blue Shield offers group employee benefits that can lead to cost savings and improved health for your company.

Employer insurance plans. Our medical pharmacy dental vision and wellness plans all work together. With UnitedHealthcare youll find a wide range of group health insurance plans for large. This is a type of plan in which an employer takes on most or all of the cost of benefit claims.

Which means you and your employees have one card and one team thats here for all of your coverage. Self-insurance is also called a self-funded plan. For specific plan details refer to the official plan documents from your employer.

But 96 of employers in the US have fewer than 50 employees and are thus not required to offer health benefits to their workers. Self-insured health insurance means that the employer is using their own money to cover their employees claims. Annual premiums in 2020 for employer-sponsored plans averaged 21342 for family coverage and 7470 for individual coverage.

Auto Life Home Health Business Renter Disability Commercial Auto Long Term Care Annuity. Give your employees health care that cares for their mind body and spirit. Why group health insurance is important for your business.

4 Many of them do of course. Most self-insured employers contract with an insurance company or independent third party administrator TPA for plan administration but the actual claims costs are covered by the employers funds. The Affordable Care Act only requires employers to offer health insurance benefitsto employees who work at least 30 hours per weekif they have 50 or more employees.

Trends in employee access and employer costs. UnitedHealthcare can help you build a healthy business. Short- and long-term disability insurance programs replace some of the wages lost by people who cannot work because of a disabling injury or illness that is not work-related.

Improve employee wellness with the power of a healthy smile Save on insurance costs. Are you an employer looking for a customized group health insurance plan for your employees. Open Access Plus OAP Open Access Plus OAP is a health plan.

Some employers will match 50 of the amount you put into the account up to 6 of income. When an employer offers a defined contribution plan or IRA the employer may also match contributions which is an added benefit. Use this guide to help you compare coverage options like HRAs and group health plans.

Dental insurance plans offer flexible affordable benefits that your employees want. For a small business health insurance is a critical factor in retaining and recruiting employees as well as maintaining productivity and employee satisfaction. Including affordable insurance as part of your employee insurance package is a smart choice.

You now have more ways to contribute to your employees health care costs with Health Reimbursement Arrangements HRAs. All of our benefits work together for better health. The plan also may be vested which means the amount of benefits you receive accrues over time.

Head-to-toe coverage for your employees We work with you to make sure your employees are covered with best-in-class insurance plans. Choosing effective sustainable health insurance coverage for your business helps build a solid foundation for balancing costs and prioritizing care for your employees. Then youre in the right place to find the benefits package you need for your business from Aetna.

Our wide range of health plans nationwide network health data insights innovative technology and dedicated team are part of how you can make the most of your group insurance benefits. Browse group plans sized 1-50. The insurance company manages the payments but the employer is the one who pays the claims.

Valued members enjoy exclusive discounts from local and national retailers on products and services. Browse self-funded ASO plans. Employee Life Insurance Plans May 2021.

Depending on the company and the plan an employers minimum contribution must often pay toward an employees policy is 50 and 0 for dependents. 0 247 virtual care options offer affordable care and convenience for your workforce. 1 Short-term disability insurance typically covers periods lasting less than 6 months and long-term disability insurance.

UnitedHealthcare offers a wide range of group health insurance options designed to help your small business save money and support. Find out whats right for your business. Simplify with easy access to services and tools to benefit you and your employees - making health insurance easy.

Browse group plans sized 51.

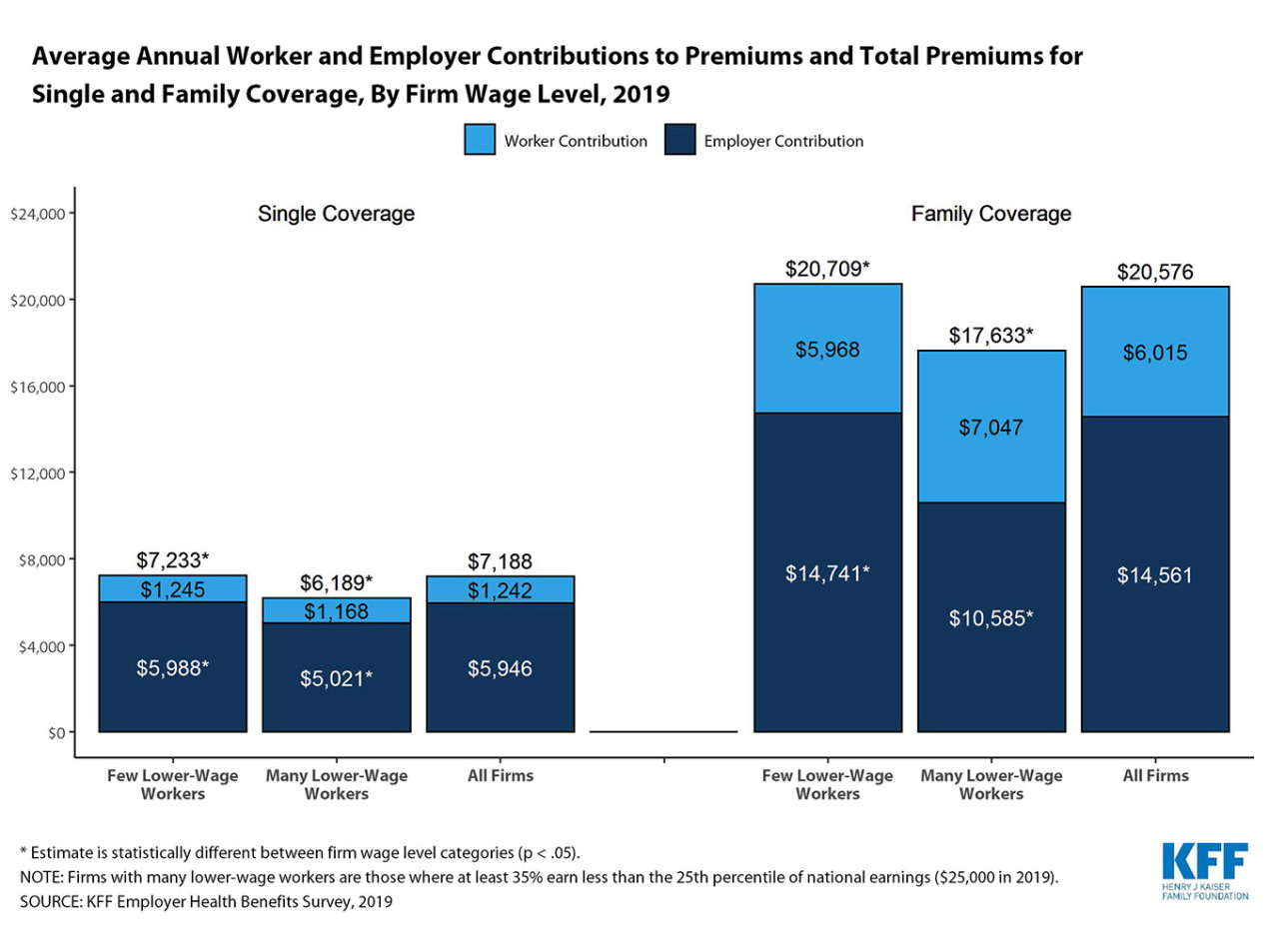

Workers Bear Ever Larger Cost Of Employer Health Insurance Plans The Lund Report

Workers Bear Ever Larger Cost Of Employer Health Insurance Plans The Lund Report

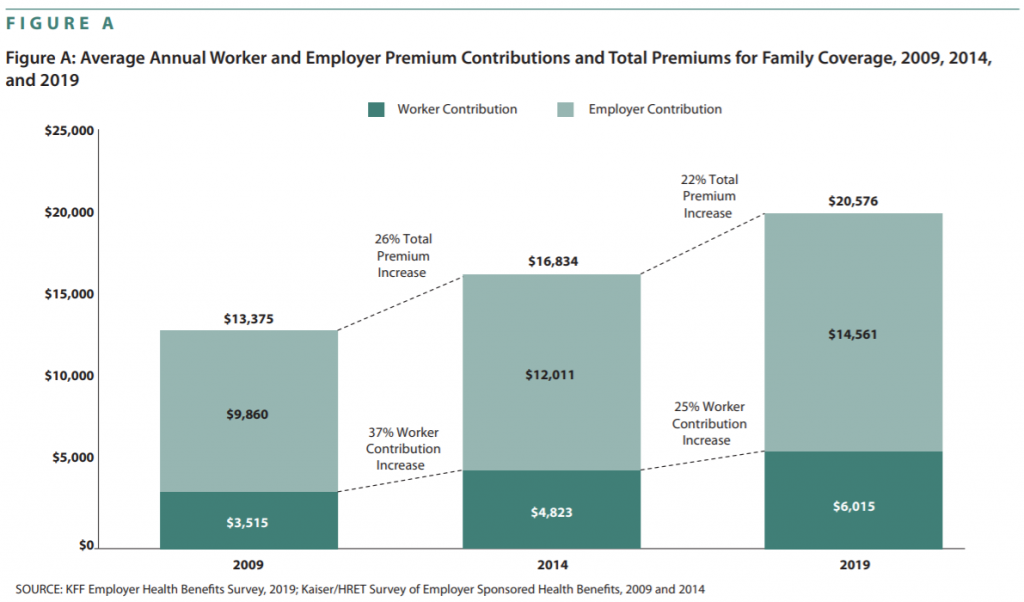

Cost Of Health Insurance Premiums On The Rise In Massachusetts Masslive Com

/coordination-of-benefits-1850523021ff453f8f4f2e19a99324ea.png) Coordination Of Benefits With Multiple Insurance Plans

Coordination Of Benefits With Multiple Insurance Plans

The Value Of Employer Provided Coverage Ahip

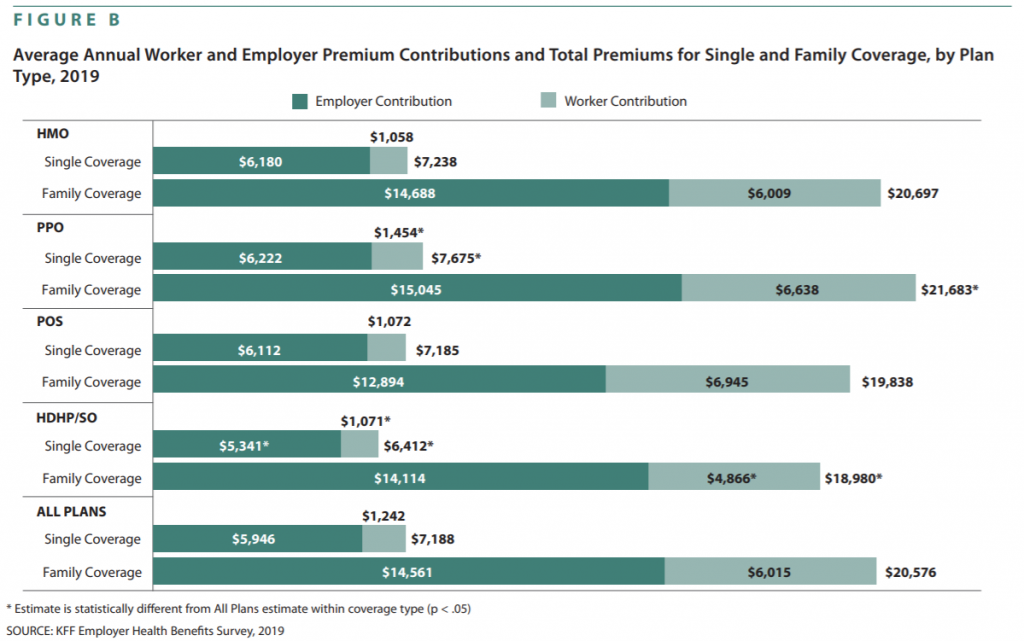

Average Cost Of Employer Sponsored Health Insurance

Average Cost Of Employer Sponsored Health Insurance

/membership-organizations-and-health-insurance-2645660_final-58ef37b9a7534e5e9e47f3da86d70d60.png) How To Get Health Insurance Membership Organizations

How To Get Health Insurance Membership Organizations

How Can I Get Medical Insurance Online

How Can I Get Medical Insurance Online

Average Cost Of Employer Sponsored Health Insurance

Average Cost Of Employer Sponsored Health Insurance

Health Insurance Plans Policies In India

Health Insurance Plans Policies In India

Illumination Wealth Managementunderstanding Your Health Insurance Plan Options Illumination Wealth Management

Illumination Wealth Managementunderstanding Your Health Insurance Plan Options Illumination Wealth Management

Employer Health Plans Keys To Lower Cost More Benefit

Employer Health Plans Keys To Lower Cost More Benefit

Top 5 Best Health Insurance Plans In India 2020 Basunivesh

Top 5 Best Health Insurance Plans In India 2020 Basunivesh

Individual Vs Employer Based Health Insurance Plan Which One Is Better

Individual Vs Employer Based Health Insurance Plan Which One Is Better

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.