Designed as an alternative to major medical insurance coverage Pivot Healths most comprehensive fixed dollar zero deductible plan called PivotCare Elite provides you easy-to-use benefits that start right away when you receive health care services related to a covered illness or injury. High-deductible plans make the subscriber pay up to several thousand for any medical care in a given year.

When To Choose A High Low Or Zero Deductible Plan

Deductible per family 0 yr.

Zero deductible health insurance plans. Some plans normally HMOs do not have a deductible at all. Yes a zero-deductible plan means that you do not have to meet a minimum balance before the health insurance company will contribute to your health care expenses. Your insurance company will cover your allowable claims right away.

One option that appeals to many for 2019 coverage is typically found in the Individual Marketplace as a Gold Level plan and that is the no-deductible health insurance policy also referred to as an all copay plan. Owner Orange County Health Life Insurance Zero deductible means exactly that - there is zero deductible. A deductible is the amount you have to pay first before the plan benefits kick in there may be some benefits in which the deductible is waived.

If there is NO deductible AND NO coinsurance there is NO out of pocket. Some of the plans include minimum essential benefits such as annual checkups prescription medication andor preventative care. Zero-deductible plans typically come with higher premiums whereas high-deductible plans come with lower monthly premiums.

Yes it is possible to get a health insurance program with no deductible. Zero-deductible plans typically come with higher premiums while high-deductible plans typically come with lower premiums. Heres what it actually means.

Max Out-of-Pocket per family 17100 yr. If you frequently visit doctors or take multiple medications a zero-deductible plan may suit your budget and coverage needs. HMOs typically offer zero deductible health insurance options.

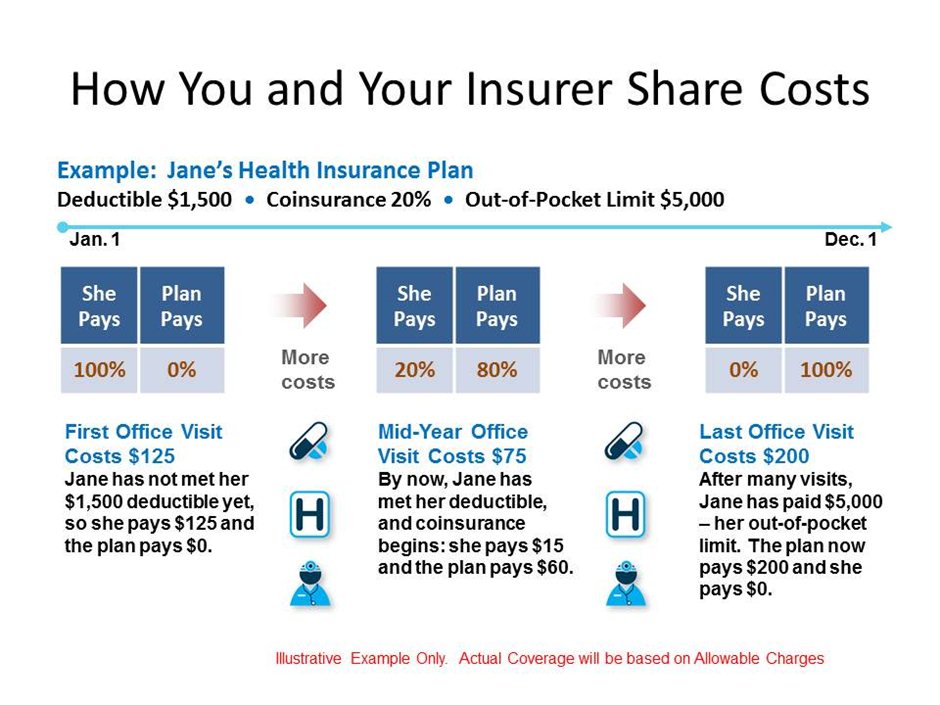

These services are provided without. Sometimes low deductible options are offered with amounts of 250 or 500 available. Your annual deductible is typically the amount of money that you as a member pay out of pocket each year for allowed amounts for covered medical care before your health plan begins to pay.

0 0 does NOT 3000. If youre insured through an employers group health insurance plan its unlikely you have a. Remember there are also copays and coinsurance.

Many no-deductible health insurance plans are employer-based health care plans. Drug Deductible per individual 4950 Drug Deductible per family 9900 Drug Max Out-of-Pocket per individual Included in Medical Drug Max Out-of-Pocket per family Included in Medical Plan Type. Deductibles can be high or low depending on.

Zero-deductible plans are offered in many states although maximum-out-of-pocket expenses may reach the allowed maximum of 8550. Furthermore Out of Pocket usually is how much your maximum payment of the Co-Insurance. 5 rânduri Zero Deductible Insurance.

With deductible plans doctor visits are often not subject to the deductible so instead of paying a hundred some dollars for the visit you just pay. These plans are known as zero-deductible plans. Right--even no deductible plans often charge say 30-50 for a doctor visit if youre sick.

Up to a 14300 family deductible. On the other side of the spectrum some self-purchased plans are the opposite of no-deductible health insurance. That means that you have to pay for 1500 worth of medical expenses out-of-pocket before your insurance plan will begin to pay for your.

What is a Fixed Dollar Zero Deductible Plan. What does a 0 deductible 0 coinsurance health insurance plan mean with a 3000 out of pocket maximum. A deductible is the amount you have to pay in that year before your insurance company covers the costs stated in your plan.

Zero-deductible plans usually come with higher premiums while high-deductible plans typically come with lower premiums. Health Insurance With A Zero-Dollar Deductible. A zero deductible plan means that you dont have to pay for any costs upfront before receiving your benefits.

For example lets say that your plan has a health insurance deductible of 1500. However this only means you pay a higher monthly premium. Aetna UnitedHealthcare Cigna and many of the Blue Cross companies offered these types of policies.

Zero-Deductible Health Insurance Plans Availability. Max Out-of-Pocket per individual 8550 yr. A health insurance deductible is the amount that you have to pay out-of-pocket before your insurance plan will cover costs.

An insurance plan with no deductible may appeal to consumers who frequently visit doctors or take several medications. What To Know About No-Deductible Health Insurance Plans. These plans are referred to as zero-deductible plans.

This excludes certain preventive services that may be automatically covered. An insurance company may lower your premiums if you are willing to accept a higher deductible meaning the.

What Is A Deductible Learn More About Your Health Insurance Options Healthmarkets

What Is A Deductible Learn More About Your Health Insurance Options Healthmarkets

No Deductible Health Insurance Is Zero The Right Option For You

No Deductible Health Insurance Is Zero The Right Option For You

How A Deductible Works For Health Insurance

How A Deductible Works For Health Insurance

Find Affordable Health Insurance And Compare Quotes

Find Affordable Health Insurance And Compare Quotes

Importance Of Understanding How Deductibles Work For Health Insurance

How Much Does Individual Health Insurance Cost Ehealth

How Much Does Individual Health Insurance Cost Ehealth

How A Deductible Works For Health Insurance

How A Deductible Works For Health Insurance

Rising Health Insurance Deductibles Fuel Middle Class Anger And Resentment Los Angeles Times

Rising Health Insurance Deductibles Fuel Middle Class Anger And Resentment Los Angeles Times

Huge Discounts On Health Insurance Some Plans With Zero Deductible Content Insurance Insurance Sales Insurance

Huge Discounts On Health Insurance Some Plans With Zero Deductible Content Insurance Insurance Sales Insurance

Decoding Doctor S Office Deductibles Blue Cross And Blue Shield Of Montana

Decoding Doctor S Office Deductibles Blue Cross And Blue Shield Of Montana

Hsa Compatible High Deductible Health Plans Www Westernhealth Com

Hsa Compatible High Deductible Health Plans Www Westernhealth Com

What To Know About No Deductible Health Insurance Plans

Health Insurance Zero Deductible Health Tips Music Cars And Recipe

How A Deductible Works For Health Insurance

How A Deductible Works For Health Insurance

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.