If you and your doctor have decided that you need a weight-loss medicine make sure you know how much you will have to pay. Part of the reluctance by Medicare and private insurers to cover weight-loss drugs stems from serious safety problems with diet drugs in the past including the withdrawal in.

Weight Loss Slimming Pills Safety Orlistat Hoodia Fat Binding Pills Alli

Weight Loss Slimming Pills Safety Orlistat Hoodia Fat Binding Pills Alli

Medicaid covers a number of prescription drugs some of which may help you manage your weight as well as other conditions such as heart disease or diabetes.

Does insurance cover weight loss medication. Contact your insurance provider to find out if your plan covers Plenity. Weight loss programs covered by insurance are part of insurance companies health incentive programs. There are three main treatment methods for obesity according to the National Heart Lung and Blood Institute.

Currently all personal family and small business plans cover basic obesity screening. Medicare Coverage for Weight Loss Medication. None of the weight loss medications.

Some Medicare Advantage plans cover health and wellness. Whether your health insurance covers these things like it covers other medical treatments depends on your insurance company and even where you live. Non formulary medications are covered when a formulary exception request is submitted to BCBSMA.

Your insurance company may not pay for the medicines. But they can be expensive. Health plans have a spotty history paying for FDA-approved weight-loss drugs and.

Theyll also probably want documented physician-supervised weight-loss attempts. There are currently no generic alternatives to Evekeo. This drug is less popular than comparable drugs.

Does Medicaid Cover Weight Loss Pills. Take time to find out about how your insurance covers the cost of these medicines. Contact your insurance provider to find out if your plan covers these medications.

Policy changes may be necessary in order for the insurance company to pay for weight loss programs. Insurers rarely cover weight-loss programs themselves. Treatment OR Documented weight loss of at least 4 of baseline body weight after the initiation of treatment first 16 weeks of treatment with Saxenda liraglutide.

You may need to do more than 300 minutes of moderate-intensity activity a week to reach or maintain your weight-loss goal. Take time to find out about how your insurance covers the cost of these medicines. Weight-loss medicines can range in cost.

Some but not all insurance plans cover medications that treat overweight and obesity. Weight loss bariatric surgery medications and nutritionalbehavioral counseling. Because of the high costs insurance companies are willing to help cover the cost of weight loss treatments as it can help lead the patient to a healthier lifestyle.

Not all insurance plans cover weight loss medication. Original Medicare benefits which includes Part A hospital insurance and Part B medical insurance do not offer coverage for any prescription medications for Medicare recipients unless they are administered during an inpatient hospital stay or in an outpatient setting. If you and your doctor have decided that you need a weight-loss medicine make sure you know how much you will have to pay.

Weight loss drugs are not a mandatory Medicaid benefit but many state Medicaid programs cover weight loss pills among their benefits. There are also requirements that you have to meet in order to get your weight loss medication paid for. It is also used as a short-term treatment along with a reduced calorie diet and exercise to help you lose weight.

Call your insurance company for more information about weight loss programs that are covered because there are different stipulations as to how much of the program will be reimbursed. Will insurance cover the cost of weight-loss medication. Weight-loss medicines can range in cost.

Kyle says both are often needed and should be covered but insurers often deny the care. But they can be expensive. Your insurer will likely require a full medical work-up along with the pre-authorization request.

You will likely need to have a BMI of 30 to get your medication covered. The majority of health plans cover some if not all of the weight-loss treatments you or your family may need. Weight Loss Medication The Affordable Care Act does not require that health insurance companies pay for weight loss medication.

Original Medicare may cover some weight management services but doesnt generally cover most weight loss programs services or medications. Programs like Weight Watchers and Jenny Craig dont count. It is not covered by most Medicare and insurance plans but manufacturer and pharmacy coupons can help offset the cost.

Https Intermountainhealthcare Org Ext Dcmnt Ncid 522600194

How To Get Your Health Insurer To Pay For Your Weight Loss Surgery

How To Get Your Health Insurer To Pay For Your Weight Loss Surgery

Are There Any Weight Loss Pills That Actually Work Does It Work Alternative Fidelity Project Eu

Are There Any Weight Loss Pills That Actually Work Does It Work Alternative Fidelity Project Eu

/prescription-diet-pill-moves-towards-over-the-counter-sales-56658752-587b7f433df78c17b6f198ed.jpg) Xenical Vs Alli Which Is Best For You

Xenical Vs Alli Which Is Best For You

Getting Life Insurance While Taking Contrave

Getting Life Insurance While Taking Contrave

Is Medical Weight Loss Covered By Insurance Advanced Chiropractic Spine Sports Medicine

Is Medical Weight Loss Covered By Insurance Advanced Chiropractic Spine Sports Medicine

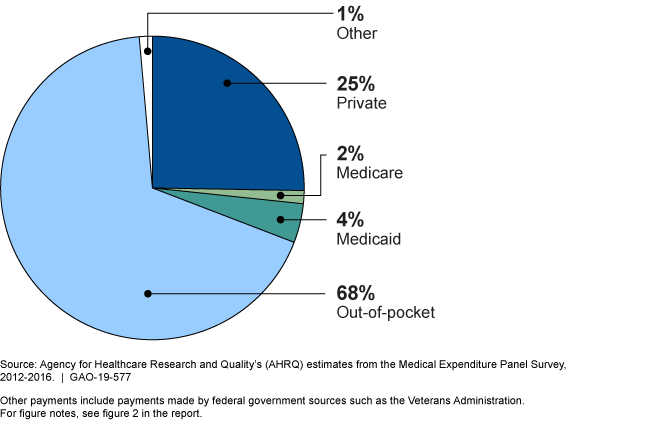

Obesity Drugs Few Adults Used Prescription Drugs For Weight Loss And Insurance Coverage Varied

Obesity Drugs Few Adults Used Prescription Drugs For Weight Loss And Insurance Coverage Varied

Many Insurers Do Not Cover Drugs Approved To Help People Lose Weight Kaiser Health News

Many Insurers Do Not Cover Drugs Approved To Help People Lose Weight Kaiser Health News

Does Insurance Cover Weight Loss Pills Iq Option Broker Official Blog

Does Insurance Cover Weight Loss Pills Iq Option Broker Official Blog

Health Insurance Coverage For Weight Loss Debra Stefan Fitness Retreat

Here S How To Save On Weight Loss Medication Contrave Goodrx

Here S How To Save On Weight Loss Medication Contrave Goodrx

Phentermine Does It Help With Weight Loss

Phentermine Does It Help With Weight Loss

Does My Health Insurance Cover Weight Loss Treatments Quotewizard

Does My Health Insurance Cover Weight Loss Treatments Quotewizard

Many Insurers Don T Cover Drugs For Weight Loss Shots Health News Npr

Many Insurers Don T Cover Drugs For Weight Loss Shots Health News Npr

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.