This plans usually the one you want to pick if you expect someone on your plan will incur significant medical expenses whether from one big event like surgery or ongoing care for a chronic condition. If youre looking to enroll in a new health insurance plan.

Is It Better To Have A High Or Low Deductible For Health Insurance

Is It Better To Have A High Or Low Deductible For Health Insurance

Low- deductible health insurance is a insurance plan that offers the consumer lower out-of-pocket costs when compared to other plans.

Low deductible health insurance plans. Youll typically be able to differentiate between high. This type of plan. Low Deductible Health Insurance Choosing Between High And Low Deductible Health Plans.

Although the premium amount is high yet out-of-pocket is far lesser for low deductible health plans when compared to high deductible health plans. ACA plans are also called health insurance marketplace plans or exchange plans. It is an ideal plan for people requiring regular medical care.

If youre looking for a UnitedHealthcare exchange plan you may find a range of affordable reliable coverage options in your area. Aetna UnitedHealthcare Cigna and many of the Blue Cross companies offered these types of policies. These costs are billed to your insurance plan first and then you will receive a bill later to cover the rest of your deductible or out-of-pocket portion.

Learn about UnitedHealthcare Exchange plans available near you or call 1-800-806-0451 TTY 711. Low-deductible plans With a low-deductible plan or even a no-deductible plan the amount you have to pay before your insurance company takes over is far less overwhelming. Some of the plans include minimum essential benefits such as annual checkups prescription medication andor preventative care.

Always opt for pet health plan that diminishes this value every payment cycle by a certain amount as your investment grows over time. Depending on your plan your deductible needs to be paid for each renew cycle or with each new incident. Low-deductible health insurance plans carry a lower deductible meaning that when you get sick you pay less money upfront before your plan starts paying.

On the other end of the spectrum low-deductible health plans typically charge more up front but require less of a financial commitment throughout the year. Low-deductible health plan basics. HDHP Low-Deductible Plan Annual Contribution4050 150pay period5400 200pay periodAnnual Deductible35001500Annual Out-Of-Pocket Maximum After meeting deductible15003.

If youre going to see the doctor every month because you have cancer or diabetes then youll want to sign up for a low. HMOs typically offer zero deductible health insurance options. The main benefit of a low-deductible plan is your medical plan will begin helping with costs sooner.

Benefits of Low-Deductible Plans. Typically you will not need to pay full appointment costs up-front and may pay only a co-pay for each visit. 2 Covers diagnostic fees.

These plans make sense for people with ongoing medical conditions or chronic illnesses. Low-Deductible Health Plan LDHP A low deductible means you pay less upfront but in exchange youll be faced with higher premium payments. But youll pay a much.

These services are provided without a. Though specifics vary by location and plan details a low-deductible plan can cost at least twice as much per month as a high-deductible plan. With a low-deductible plan or even a no-deductible plan the amount you have to pay before your insurance company takes over is far less overwhelming.

1 A lower deductible. Zero-deductible plans are offered in many states although maximum-out-of-pocket expenses may reach the allowed maximum of 8550. Sometimes low deductible options are offered with amounts of 250 or 500 available.

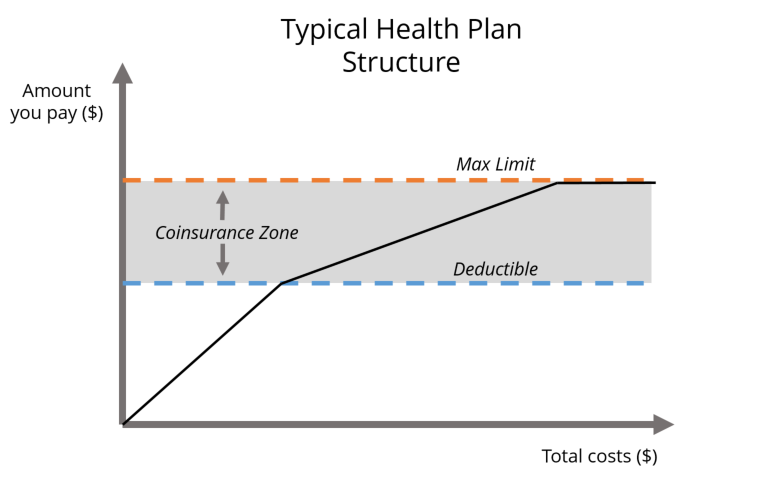

The deductible is an amount of money that must be paid by the consumer for health care per year before the insurance plan will start to cover any medical bills. But youll pay a much higher premium for these plans. The trade-off is that youll pay more for your monthly premium when you have low-deductible coverage.

Low Deductible Health Insurance Plans A higher upfront premium amount needs to be paid.

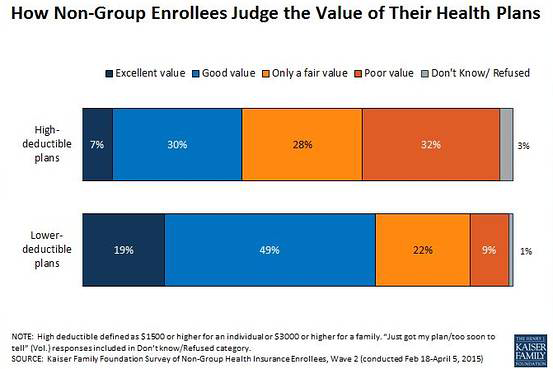

The Value Trade Off In High Deductible Health Plans Kff

The Value Trade Off In High Deductible Health Plans Kff

The Pros And Cons Of High Deductible Health Plans Hdhps

The Pros And Cons Of High Deductible Health Plans Hdhps

How A Deductible Works For Health Insurance

How A Deductible Works For Health Insurance

What Is A Health Insurance Deductible Clydebank Media

What Is A Health Insurance Deductible Clydebank Media

Newsroom A Millennial S Guide To Choosing Health Insurance

Newsroom A Millennial S Guide To Choosing Health Insurance

Report Majority Of Companies Offer High Deductible Health Plans

Report Majority Of Companies Offer High Deductible Health Plans

Dismissing High Deductible Hsa Plans Is A Costly Mistake Resource Planning Group

Find Affordable Health Insurance And Compare Quotes

Find Affordable Health Insurance And Compare Quotes

Health Insurance Hacks Deductibles

Health Insurance Hacks Deductibles

Rising Health Insurance Deductibles Fuel Middle Class Anger And Resentment Los Angeles Times

Rising Health Insurance Deductibles Fuel Middle Class Anger And Resentment Los Angeles Times

How To Choose The Best Health Insurance Plan Doc On A Mission

How To Choose The Best Health Insurance Plan Doc On A Mission

Hsa Compatible High Deductible Health Plans Www Westernhealth Com

Hsa Compatible High Deductible Health Plans Www Westernhealth Com

What Is A Deductible Learn More About Your Health Insurance Options Healthmarkets

What Is A Deductible Learn More About Your Health Insurance Options Healthmarkets

How Much Can Your Family Save With Direct Primary Care Direct Osteopathic Primary Care

How Much Can Your Family Save With Direct Primary Care Direct Osteopathic Primary Care

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.