Larger amounts are prorated over a longer timeframe Medicaid eligibility is based on monthly income. Prior to passage of the American Rescue Plan in March 2021 I was at 166 of the FPL.

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

To qualify for a subsidy your household income must be between 100 and 400 of the FPL.

Income level for obama care 2020. Marketplace savings are based on your expected household income for the year you want coverage not last years income. You may see documents. To spend 30 of their after tax income on health care is a large percentage.

Please note marketplace cost assistance can be taken in advance based on income projects but is adjusted for actual income at tax time. Whose income to include in your estimate. Hence it is always important for people to continue saving no mater what their income level.

When I listed the above income ranges I bet. You can enroll in Marketplace health coverage through August 15. You may need to file an amended 2015 tax return.

You will be asked about your current monthly income and then about your yearly income. Still need 2021 health coverage. Glad for so many who were paid unemployment in 2020 that 10200 of unemployment is tax exempt but it appears to create a problem or at least confusion with 2020 ACA while doing 2020 taxes.

Here are the limits for 2020 plans for individuals and families. In 2021 Obamacare subsidies begin if your health plan cost is greater than 85 of your household income towards the cost of the benchmark plan or a less expensive plan the benchmark plan is the second-lowest silver plan. Please keep in mind the years we say the numbers are for below.

If you meet these criteria youll be eligible for a subsidy on a sliding scale based on your income. For those enrollees premium subsidies cover the bulk of their premiums. Health care.

For example in Kansas where only able-bodied adults with children and with an income below 32 of the poverty line were eligible for Medicaid those with incomes from 32 to 100 of the poverty level 6250 to 19530 for a family of three were ineligible for both Medicaid and federal subsidies to buy insurance. This happens when your household income exceeds 400 of the applicable poverty line the government draws this line based upon your state of residence and household size. The average full-price plan across the 38 states that used HealthCaregov in 2020 was 595month but.

A family making 50000 a year should bring home roughly 35000-40000 after taxes. The discount on your monthly health insurance payment is also known as a premium tax credit. To qualify for an Obama Phone most states require that your total household income must be no higher than 135 of the Federal Poverty Guideline.

You must make your best estimate so you qualify for the right amount of savings. Absent children able-bodied adults were not eligible for Medicaid. How can you tax my income when my husband only had obama care up until the month before we were married.

What Do The FPL Levels Mean. Exemptions in 2018. For 2020 coverage those making between 12490-49960 as an individual or 25750-103000 as a family of 4 qualify for ObamaCare.

Select an article Income levels. If your income and assets are very low you may qualify for Medicaid health coverage immediately. The penalty for not having coverage in 2018.

Thus if you make between 12760 51040 as an individual or 26200 104800 for a family in 2021 youll qualify for cost assistance. For 2020 your maximum deductible is the same as the out-of-pocket maximum. For 2021 those making between 12760-51040 as an individual or 26200-104800 as a family of 4 qualify.

Of those 96 million or 84 percent received premium subsidies. Cindy on December 13 2016. How to save on your monthly insurance bill.

Qualified lottery winnings and lump-sum income including inheritances tax refunds etc is only counted in the month its received if its less than 80000. For example for 2020 coverage and 2019 MedicaidCHIP youll reference the 2019 Federal poverty Levels and for 2021 cost assistance and 2020 MedicaidCHIP youll reference the 2020 federal poverty levels. Further you may need to reference older poverty level guidelines if you are doing taxes.

Premium subsidy eligibility on the other hand is based on annual income. If your total income is below 100 percent of the FPL you should apply for Medicaid in your state. With passage of the American rescue plan 10200 of my unemployment pay in 2020.

2019 exemptions. To assist your Obamacare planning for 2020 Ive used the Javascript programming language to create an interactive online calculator. A few states California Alaska and Hawaii have their own rates that are higher than the 135.

This would increase your income to 280000 making 80000 of your total income subject to the 38 surtax. I had significant income from unemployment in 2020. This calculator shows how.

This would result in you owing roughly 3040 in extra taxes just from the Medicare Surtax. Browse all topics Featured. Your question is old but there is a special computation on Form 8962 if one of your got married during the year to correct much of the problem you had.

For 2020 your out-of-pocket maximum can be no more than 8150 for an individual plan and 16300 for a family plan before marketplace subsidies. What is the maximum income for ObamaCare. The Affordable Care Act definition of MAGI under the Internal Revenue Code 2 and federal Medicaid regulations 3 is shown below.

The point is at least we know our backstop cost and can plan accordingly. All but 16 states have chosen to allow people making up to 138 of the FPL to qualify for Medicaid. But you must also not have access to Medicaid or qualified employer-based health coverage.

For 2021 assistance youll use the 2020 poverty levels. Under the Affordable Care Act eligibility for income-based Medicaid 1 and subsidized health insurance through the Marketplaces is calculated using a households Modified Adjusted Gross Income MAGI.

2015 Aca Obamacare Income Qualification Chart My Money Blog

2015 Aca Obamacare Income Qualification Chart My Money Blog

Obamacare Calculator Subsidies Tax Credits Cost Assistance

Obamacare Calculator Subsidies Tax Credits Cost Assistance

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

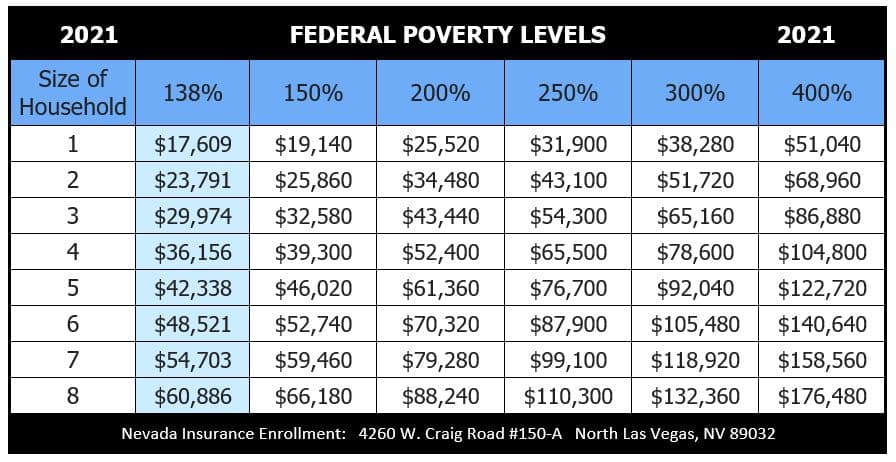

2021 Health Insurance Federal Poverty Level Chart

2021 Health Insurance Federal Poverty Level Chart

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

Are You On The Edge Of The Aca Subsidy Cliff Ehealth Insurance

Are You On The Edge Of The Aca Subsidy Cliff Ehealth Insurance

2021 Obamacare Subsidy Calculator Healthinsurance Org

2021 Obamacare Subsidy Calculator Healthinsurance Org

Health Insurance Marketplace Calculator Kff

Health Insurance Marketplace Calculator Kff

Income Based Costs Nevada Health Link Official Website Nevada Health Link

Income Based Costs Nevada Health Link Official Website Nevada Health Link

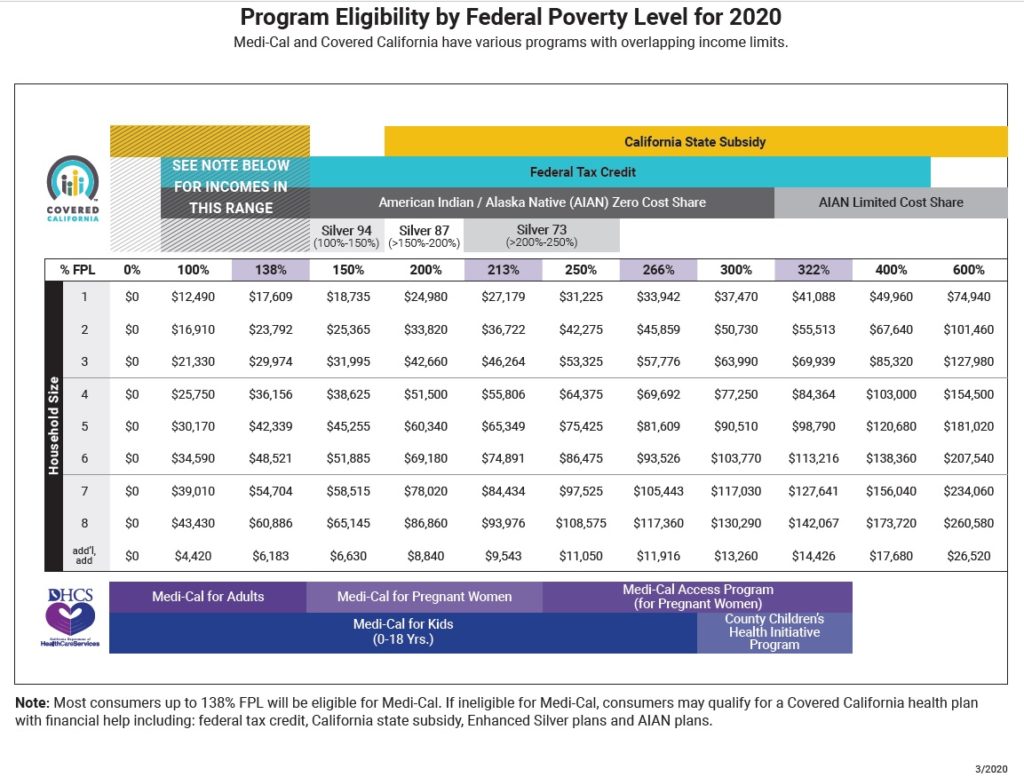

Revised 2020 Covered California Income Eligibility Chart

Revised 2020 Covered California Income Eligibility Chart

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

2020 2021 Federal Poverty Levels Fpl For Affordable Care Act Aca Florida Health Agency

2020 2021 Federal Poverty Levels Fpl For Affordable Care Act Aca Florida Health Agency

Are You Eligible For A Subsidy

Are You Eligible For A Subsidy

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.