You also wont have to worry about. Medigap Plan G is a Medicare supplement.

Medicare Supplement Plan G What Are The Facts Gomedigap

Medicare Supplement Plan G What Are The Facts Gomedigap

Original Medicare beneficiaries who are prescribed the Dexcom G6 system are required to schedule a follow-up appointment every six months for testing.

What does medicare plan g cover. With Plan G you will need to pay your Medicare Part B deductible. Plan G covers Skilled Nursing and rehab facility stays and also Hospice care. To be more specific Medicare Plan G covers your Part A deductible and coinsurance for inpatient care.

Medicare Supplement Plan G also covers 80 of medical care you receive while traveling outside the US up to your plans limits. Medicare does not cover if your Dexcom G6 supplies are only used with mobile devices. Preventive screening services.

Although MedSup Plan G helps you pay most of the healthcare costs Original Medicare or Medicare Part A and Part B doesnt cover it doesnt help you pay all of them. For starters it wont cover the cost of your annual Part B deductible. Medigap Plan G is a Medicare supplement insurance plan.

What Medicare health plans cover. Whats not covered by Part A Part B. Additionally Plan G is the only Medicare Supplement other than Plan F that will cover all of the excess charges Part B may have.

Supplemental insurance plans help cover certain health care costs such as deductibles coinsurance and copayments. Unfortunately Plan G doesnt cover every type of medical expense. Part G does not cover Part B deductibles.

It also covers outpatient medical services such as doctor visits lab work diabetes. Without a supplement plan youd have to pay those expenses yourself. So it helps to pay for inpatient hospital costs such as blood transfusions skilled nursing and hospice care.

Medicare Supplement Plan G is a Medigap plan that provides additional coverage compared to Original Medicare. Youll have to pay for the items and services yourself unless you have other insurance. If you dont follow this requirement then Medicare Part B will stop providing coverage for the Dexcom G6 system.

Medicare Part A Deductible When youre admitted to a hospital for inpatient care you will begin whats called a benefit period. An excess charge happens when a provider or doctor doesnt accept Medicare assignment. Medigap is supplemental insurance plan sold by private companies to help cover original Medicare costs such as deductibles copayments and coinsurance.

What Plan G Doesnt Cover. This means you should plan. Because Medicare supplement plans are offered through private insurance companies the companies will set their own premiums so they will vary.

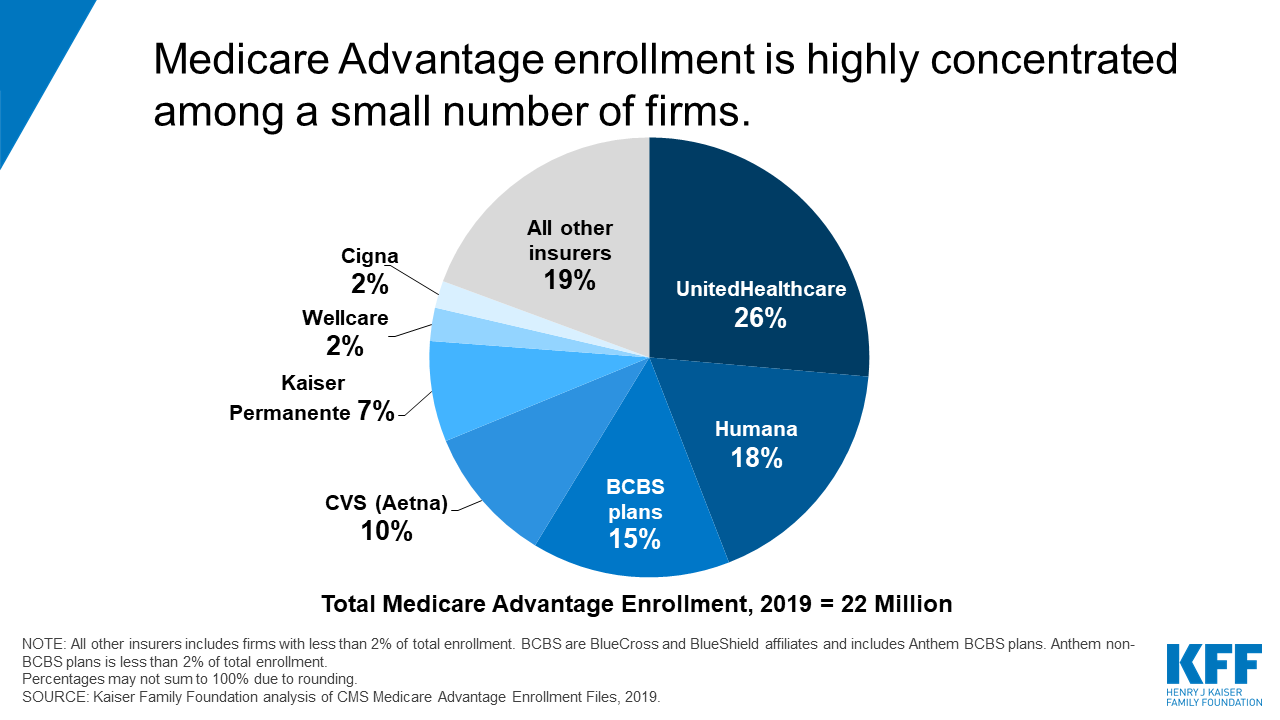

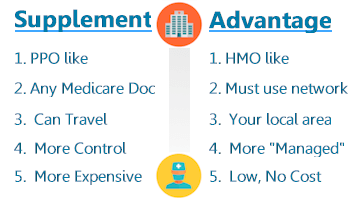

Medicare health plans include Medicare Advantage Medical Savings Account MSA Medicare Cost plans PACE MTM. All Medicare supplement plans require you to pay a monthly premium. In their initial research phase many people compare Plan G to Plan F which covers the Part B deductible.

How Much Does Medicare Supplement Plan G Cost. Plan G is a type of supplemental insurance for Medicare. What doesnt Medicare Part G cover.

Learn about what items and services arent covered by Medicare Part A or Part B. It also pays your Medicare Part A hospice and skilled nursing coinsurance costs. Premiums are set by each state and each insurance provider.

These benefits include the following. Medicare Supplement Plan G covers most of the out-of-pocket costs that Original Medicare leaves you open to with one exception. Medicare Supplement Plan G covers eight of the nine benefits that are covered by the standardized Medicare Supplement Insurance plans offered in most states.

If you have a Medicare health plan your plan may cover. Plan G covers 100 of the Medicare Part A and Part B co-pays and coinsurance those gaps and holes that Medicare doesnt cover. It covers a variety of expenses that arent covered by Medicare parts A and B such as coinsurance copays and some deductibles.

The Part B deductible for 2021 is 203. Part B covers many preventive services. For Part B costs Plan G includes coinsurance and copayment costs and excess charges.

Medicare Supplement Plan G coverage includes Medicare Part A coinsurance and hospital costs hospice care coinsurance and copayment and the deductible. Medicare Supplement Plan G covers your share of any medical benefit that Original Medicare covers except for the outpatient deductible. What Medical Services Does Plan G Cover.

However it does not cover. And it covers 100 percent of the cost of your first three pints of blood if needed for a transfusion.