The penalty applies to those months in which you or your family did not have health insurance coverage. Have qualifying health insurance coverage.

2020 California Health Insurance Tax Penalty How Much Will You Owe Ask Ariana Healthcare Access

2020 California Health Insurance Tax Penalty How Much Will You Owe Ask Ariana Healthcare Access

- Free Quote - Fast Secure - 5 Star Service - Top Providers.

Penalty for not having health insurance in california. Check out our affordable health plans and calculate your premium. Advertentie Compare Top Expat Health Insurance In Netherlands. Advertentie Compare Quotes Save Money On Expat Health Insurance in California.

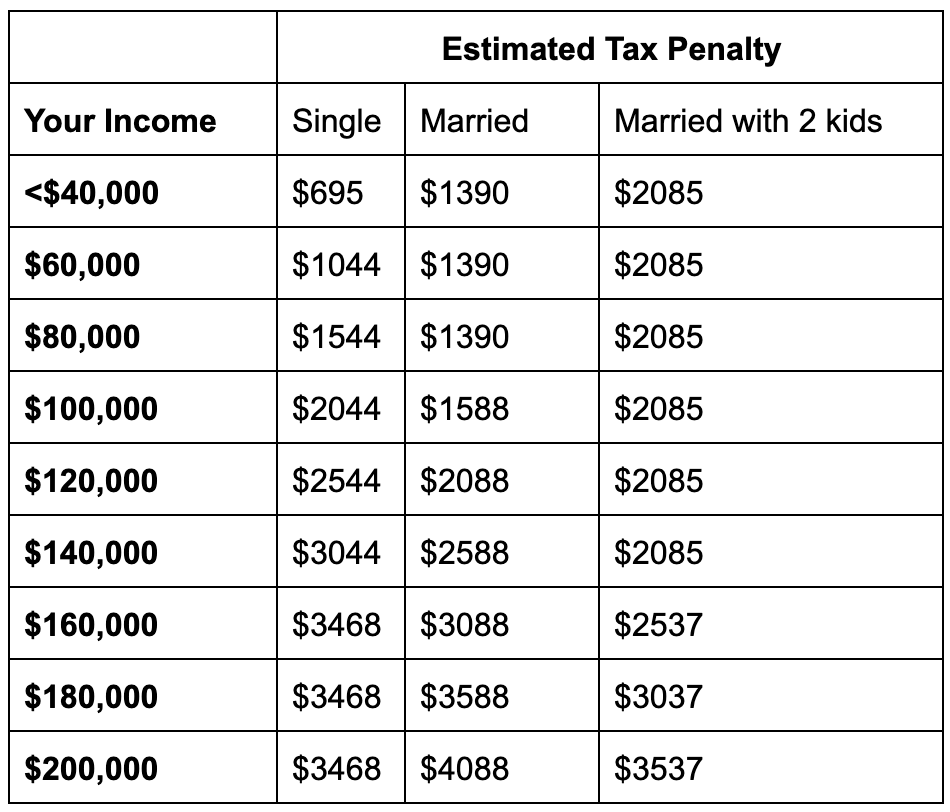

Household size If you make less than You may pay. Family of 4 2 adults 2 children 142000. The penalty for not having coverage the entire year will be at least 750 per adult and 375 per dependent child under 18 in the household when you file your 2020 state income tax return in 2021.

The tax penalty was eliminated in 2017 by the Trump administration but the state of California has reinstated it for 2020. The penalty will amount to 695 for an adult and half that much for dependent children or 25 of household income whichever is greater. So many are unemployed due to COVID-19.

Advertentie Compare Quotes Save Money On Expat Health Insurance in California. Obtain an exemption from the requirement to have coverage. That could make the penalty quite a bit heftier for some.

The penalty will amount to 695 for an adult and half that much for dependent children. For at least the first three years the penalty will be used to offset the states cost to provide larger health insurance subsidies. If you arent covered and owe a penalty for 2020 it will be due when you file your tax return in 2021.

Get an exemption from the requirement to have coverage. Read our blog to learn more. Check out our affordable health plans and calculate your premium.

- Free Quote - Fast Secure - 5 Star Service - Top Providers. Beginning January 1 2020 all California residents must either. Get the Best Quote and Save 30 Today.

Advertentie Zilveren Kruis healthcare insurance is the foremost collective healthcare insurer. Gavin Newsom recently established a statewide penalty for not carrying health insurance to replace the one that the federal government eliminated. Sample penalty amounts.

If you are a Californian with no health insurance in 2020 you may face a tax penalty in 2021. California residents who do not have health insurance in 2020 will have to pay a tax penalty in 2021. Get the Best Quote and Save 30 Today.

Starting in 2020 California residents must either. Will there be a tax penalty in California for not having health insurance in 2020. The penalty for a full twelve months of no minimum essential health insurance coverage will either be a flat amount of 750 per adult 375 per dependent or 25 percent of the gross income that exceeds the filing threshold whichever is higher.

Though in 2019 the Trump administration rescinded the tax penalty established by the Affordable Care Act you may still need to pay a tax penalty in 2021 if you live in California and do not have health insurance. Subscribe to California Healthlines free Daily Edition. Advertentie Zilveren Kruis healthcare insurance is the foremost collective healthcare insurer.

The penalty is on the. Pay a penalty when they file their state tax return. As of this date California has not indicated that the penalty will be rescinded for tax year 2020.

You will begin reporting your health care coverage on your 2020 tax return which you will file in the spring of 2021. Advertentie Compare Top Expat Health Insurance In Netherlands.