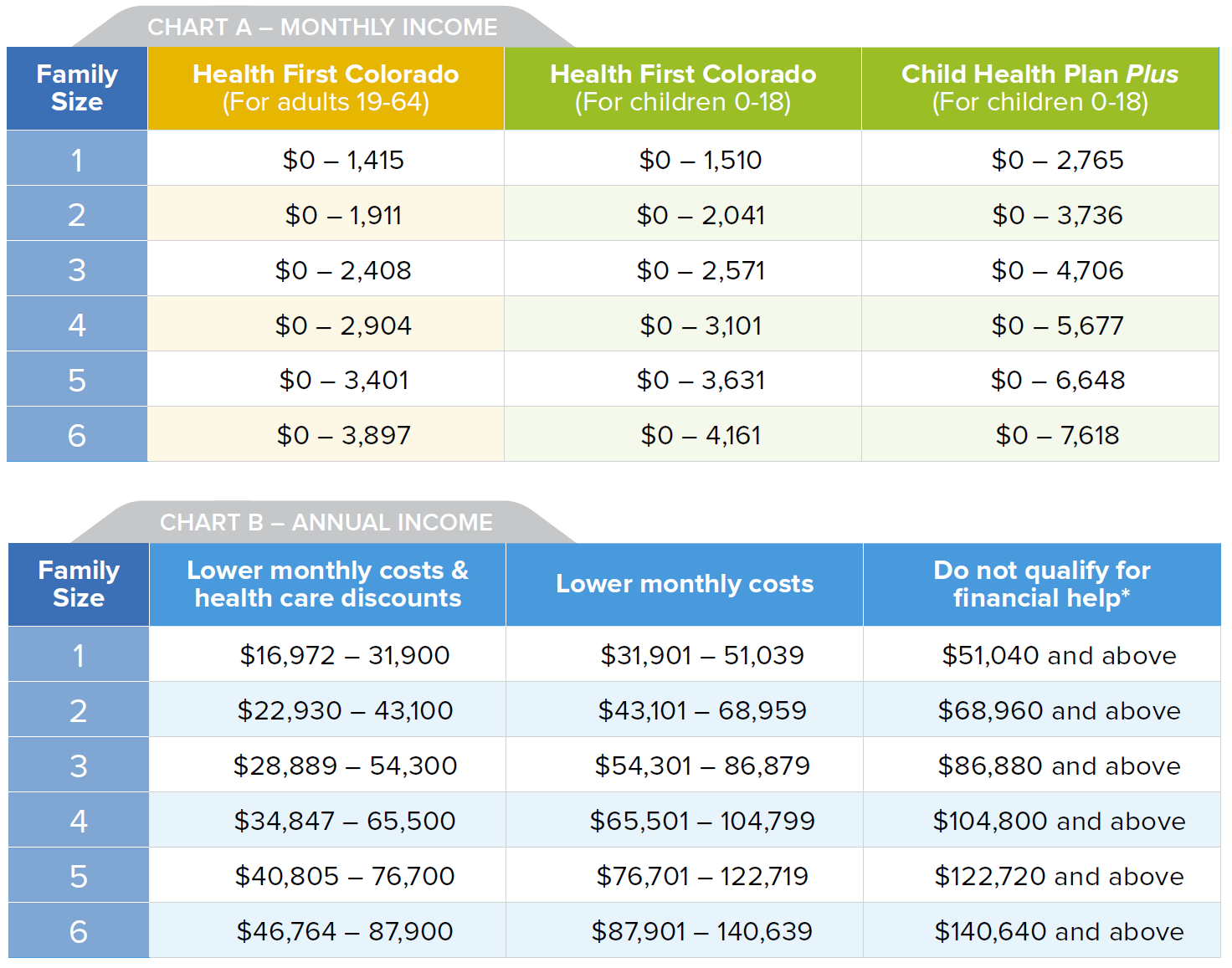

If you buy health insurance from healthcaregov or a state-run ACA exchange up through the year 2020 whether you qualify for a premium tax credit is determined by your income relative to the Federal Poverty Level FPL. Based on your income and family size you may be able to get a subsidy also known as a premium tax credit or financial help.

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

The premium tax credit is available to individuals and families with incomes between the federal poverty line and 400 percent of the federal poverty line 1 who purchase coverage in the health insurance marketplace in their state.

Premium tax credit income limits 2019. But as long as your MAGI is less than 400 of the poverty level the amount of the premium tax credit that youll have to repay is capped at no more than 1325 if youre a single filer and no more than 2650 if you have any other tax filing status these numbers are for the 2019 tax year. If the advance credit payments are more than the amount of the premium tax credit you are allowed called excess advance credit payments you will add all or a portion of the excess advance credit payments to your tax liability on Form 1040 Schedule 2. Family of one 12760.

Less than 133 then the initial percentage is 208 and the final percentage is 208. If you are enrolled in more expensive coverage you will pay the additional amount. If you claim a net Premium Tax Credit for 2020 you must file Form 8962.

Your income must also be above the range for Medicaid eligibility or above 100 of the FPL in states that didnt expand Medicaid for adults. Get Your Estimated Tax Credit Using our premium tax credit estimator lets you see how much help you may get. Locate line where estimated 2019 household income household size intersect 2.

IRS Suspends Requirement to Repay Excess Advance Payments of the 2020 Premium Tax Credit. For tax years beginning in 2019 the Applicable Percentage Table for purposes of Code Sec. Analysis of the 2019 MTSP Limits The 2019 national median income is 75500 which is a 5 increase from 2018.

If your household makes less than 100 of the federal poverty level you dont qualify for premium tax credits Obamacare subsidies. If that total income is within the subsidy. The premium tax credit is limited by comparing the cost of your coverage to that of the second lowest cost silver plan that covers you and your family.

The American Rescue Plan Act of 2021 also known as President. However youre probably eligible for Medicaid depending on your states rules. This can help lower the amount you might pay for your health care coverage each month.

They were slightly smaller at 1300 and 2600 for the 2018 tax year. However if you are enrolled in coverage that costs less your share of the premium will also be less. If you have excess advance Premium Tax Credit for 2020 you are not required to report it on your 2020 tax return or file Form 8962 Premium Tax Credit.

2019 PREMIUM TAX CREDIT QUICK REFERENCE CHART Based on 2018 Federal Poverty Lines 1. If your year-end income exceeds 400 FPL you will have to return the total amount of Advanced Premium Tax Credits you received. So assuming youre losing your employer-sponsored plan at the end of July they will look at the income you earned for the first seven months of the year plus what you expect to earn for the final five months of the year.

For tax years other than 2020. Heres the 100 level for 2021. To learn more its important to apply directly to your states Medicaid program.

Where household income as a percentage of the Federal poverty line is. Your eligibility for a premium tax credit will be based on your total income for the whole year since it will have to be reconciled on your 2020 tax return. Income Limit Grace Period.

As HUD caps income limit increases at twice the change in the national median income the 2019 income increase cap is 10. That was a hard cutoff. Federal poverty levels FPLs premium tax credit eligibility Income between 100 and 400 FPL.

For tax years 2021 and 2022 you can still qualify with income of 400 and higher. 36Bb3Ai and the accompanying reg Reg. Youll see your official premium tax credit amount when you buy your health plan.

A premium tax credit is also available to lawfully residing immigrants with incomes below the poverty line who are not eligible for Medicaid because of their immigration status. You didnt qualify for a premium tax credit if your income was above 400 of FPL. Less Than 100 of FPL.

First column shows household of Federal Poverty Line- if between 100 and 400 continueotherwise stop ineligible 3. This will result in either a smaller refund or a larger balance due. 2019 adjusted items.

If you make too little to qualify for subsidies less 100 FPL then you should owe NOTHING per the directions of form 8962 from which this table comes. Second column shows of household income required towards purchase 2nd lowest cost Silver. If your income is in this range in all states you qualify for premium tax credits that lower your monthly premium for a Marketplace health insurance plan.