What are the differences between HMO and PPO plans. Now what is the difference between PPO and HMO in Medicare.

Preferred Provider Organization PPO While both Medicare HMO and PPO typically have more similarities than differences the main contrast comes down to premiums or higher costs in.

What is the difference between ppo and hmo medicare plans. HMO plans may require that beneficiaries choose a primary care physician. An HMO offers no coverage outside of the network but patients typically enjoy lower premiums. When choosing a Medicare plan that is best for you or your loved ones you may want to consult a plan representative to better understand the advantages of each plan.

Medicare Advantage HMO plans and PPO plans are probably more alike than different. Both plans use a network of healthcare services. With a PPO the trade-off for receiving a little bit of coverage outside of your network is usually a higher monthly premium.

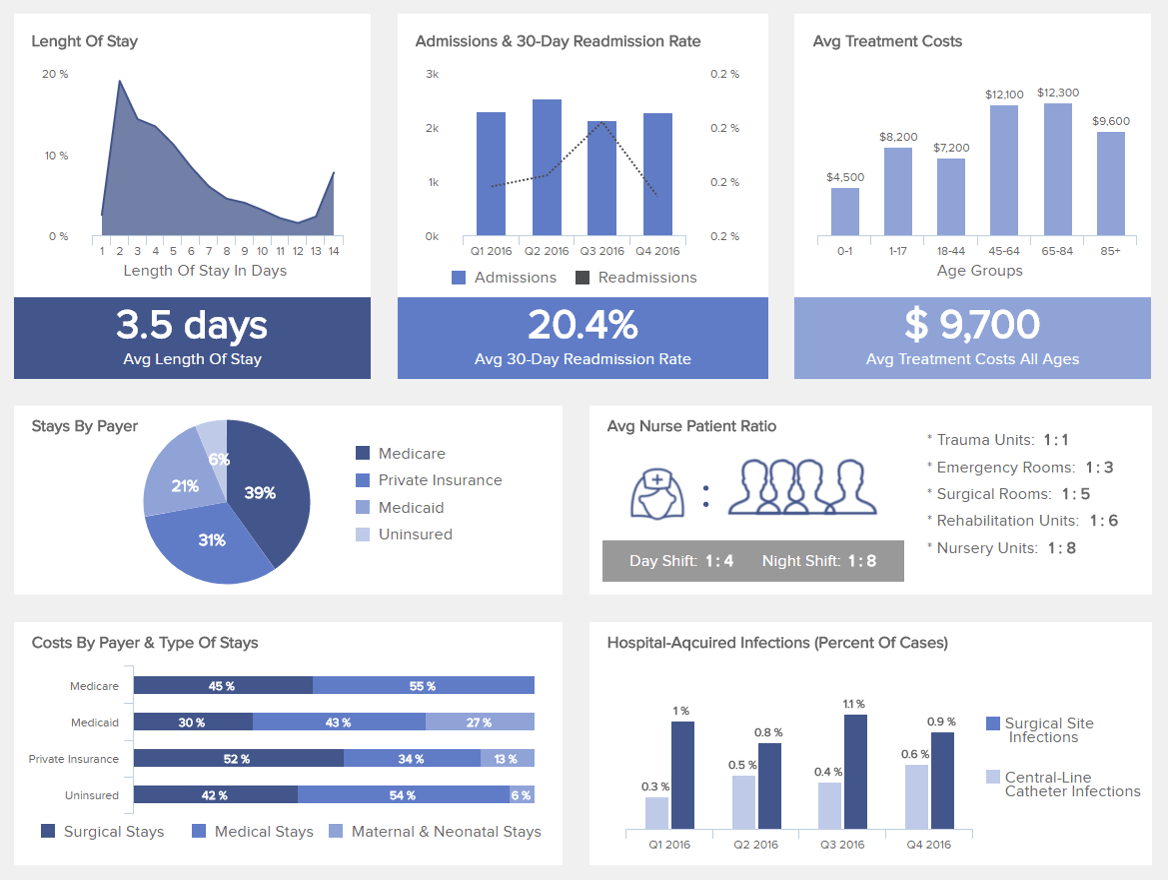

HMOs cost less every month and sometimes dont have any deductibles. Care you receive in-network through the HMO has a different deductible than care you receive out-of-network through the POS. PPO plans cost more than HMO plans.

The cost of health insurance is an important differentiator between an HMO and a PPO. PPO plans do not require that beneficiaries choose a primary care physician. Whats a Medicare PPO plan.

HMO plans generally have lower monthly premiums than Medicare Supplement plans and are available with prescription drug coverage so you can have medical and drug coverage in one plan. Although they generally have provider networks Medicare Advantage PPOs let you see doctors outside the plan network. There are several differences in costs and coverage between Original Medicare and Health Maintenance Organizations HMOs.

Primary care physicians HMO plans generally require members to utilize a primary care physician PCP while PPO plans typically do not. The table below shows a summary of information for Medicare Advantage PPO and HMO plans. See any provider and use any facility that accepts Medicare participating or non-participating See any provider but generally pay more when seeing out-of-network providers.

Medicare Advantage HMO plans offer some of the following features. Your out-of-pocket costs with a PPO plan will typically be lower if you use the PPO plans network of preferred providers. Here are the differences that matter.

Compared to PPOs HMOs cost less. 5 Zeilen How much will this plan cost. There are a few key differences between HMO and PPO plans.

What is a Medicare Advantage PPO. The two deductibles cannot be combined - they must be reached separately. Must choose a primary care physician.

A provider network is a list of doctors hospitals and other health care providers under contract with a health plan. 7 Like HMOs many POS plans require you to have a PCP referral for all care whether its in or out-of-network. There are many ways PPOs and HMOs compare.

In general Medicare PPOs give plan members more leeway to see providers outside the network than Medicare HMOs do. The table below compares these two ways of getting Medicare benefits. POS plans resemble HMOs but are less restrictive in that youre allowed under certain circumstances to get care out-of-network as you would with a PPO.

Medicare HMO and PPO plans differ mainly in the rules each has about using the plans provider network. As mentioned above Differences between HMO Health Maintenance Organization and PPO Preferred Provider Organization plans include network size ability to see specialists costs and out-of-network coverage. One major difference between HMO and PPO plans is that you can typically get your care from any provider you choose with a PPO.

With an HMO plan you have a primary care physician or PCP who keeps track of all your care and refers you to specialists. However PPO plans offer. If you are interested in joining an HMO make sure to speak to a plan representative for more information.

You dont have to choose a primary care provider with a Medicare PPO but you do with an HMO. The biggest difference between the two being provider flexibility among other things. These plans are similar to traditional insurance as they operate off of a network like an HMO or PPO.

But there are a few HMO vs. See only in-network providers. However PPOs generally offer greater flexibility in seeing.

Both HMO and PPO plans generally include prescription drug coverage through a Medicare Advantage Prescription Drug plan MAPD. They have higher monthly premiums and higher deductibles. HMO plans typically have lower monthly premiums.

Visit doctors anywhere in the US. The HMO and POS portions of the plan have separate deductibles. 2 Zeilen Both HMO and PPO plans rely on using in-network providers.

You might have to pay higher coinsurance or copayments for seeing out-of-network providers. Cost On average HMO members can generally expect to pay lower premiums than members of PPO plans.