Office visit copayments or coinsurance typically cost around 10-30. Emergency room copayments or coinsurance will cost you far more likely between 100-300.

A specialist visit may take a 50 copay.

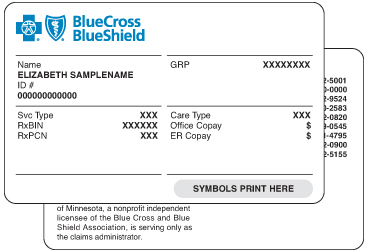

Er copay blue cross blue shield. ER accidental injury 0 within 72 hours 125 per day per facility 0 within 72 hours ER medical emergency 15 of our allowance 125 per day per facility 30 of our allowance Lab work such as blood tests 15 of our allowance 0 copay1 0 for first 10 specific lab tests Diagnostic services such as sleep studies X-rays CT scans 15 of our allowance. Your copayments are usually a fixed dollar amount for example 10 20 or 30 you pay each time you use a particular medical service or fill a prescription. Emergency room copays can cost you hundreds of dollars.

And doctors and analysts have a lot to say about it. Your local ER is available 24 hours a day seven days a week and can treat serious illnesses and injuries. Your Blue Cross ID card may list copays for some visits.

The relative member costs described here are for network providers. That specialized care also makes them more expensive. A trip to the ER could be as much as a 200 copay.

It will have a list of your copays for different types of visits. 580700 Child emergency room visit newborn to 16 years Common reasons for ER visits include ear infections sinus infections fever injuries. If you arent able to ask when admitted ask when youre well enough if you can be transferred to.

You may have a 30 copay for a primary care doctor visit. Theyre open 24 hours seven days a week. As shown below healthcare services are put in seven simple benefit levels with copayments for in-network services.

You may also have a copay after you pay your deductible and when you owe coinsurance. The amount of the copay can change depending on where you go. Your plan determines what your copay is for different types of services and when you have one.

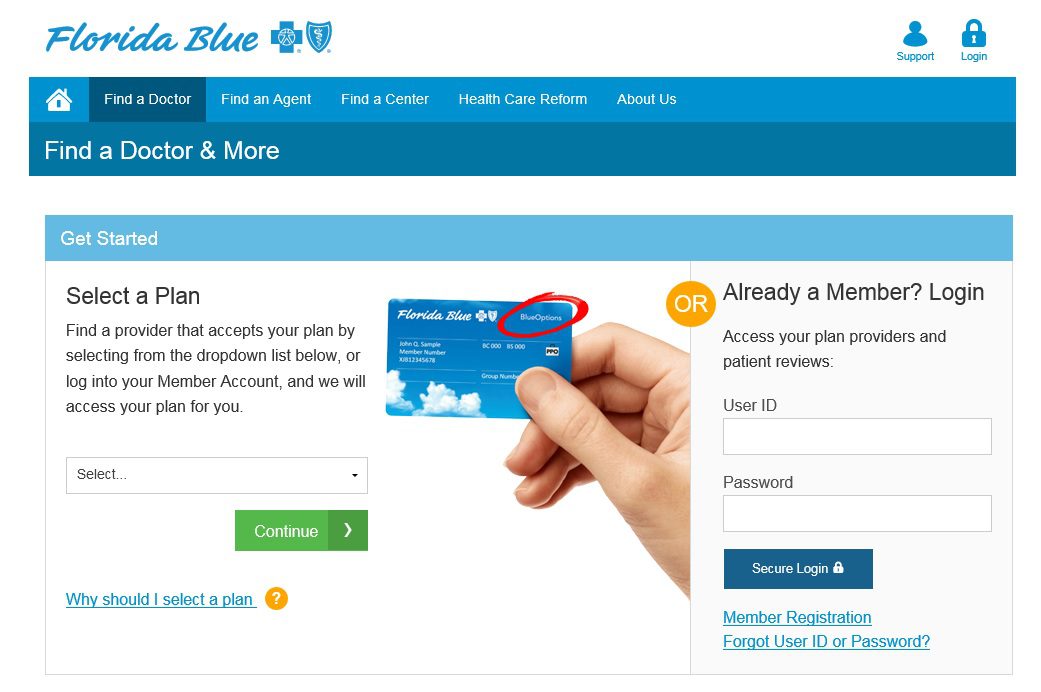

Like us on Facebook Blue Cross Blue Shield is enacting this policy because it doesnt want people to use the emergency room as their primary health care. The Blue Connect All Copay Plan features predictable easy-to-understand pricing. Georgia hospital system sues Blue Cross Blue Shield for Anthem imaging policy As of January 1 Anthem said it would always pay for ER visits based on certain conditions.

You may have a copay before youve finished paying toward your deductible. A copay is a fixed price you usually pay when you get care. Your plan includes both in-network and out-of-network coverage but you will pay more when you visit an out-of-network doctor or hospital.

A specialist visit may take a 50 copay. To get a clear understanding of your coverage benefits you can review your policy kit check your plan details in Blue Access for Members or call the number on the back of your membership ID card. ER copays can be a lot higher than doctor visit copays.

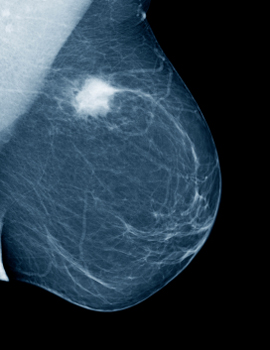

Adult emergency room visit Common reasons for ER visits include chest pain fainting headaches injuries respiratory problems stomach pain and urinary tract infections. Not all plans and services require copays. You may have a 30 copay for a primary care doctor visit.

Take a look at your member ID card. Take a look at your member ID card. Providers have said it puts patients in harms way when they have to decide whether their conditions constitute an emergency.

14 rijen Beginning January 1 2017 and December 24 2016 for certain. If you are told you need to be admitted ask to be moved to a hospital that is in network. For medical emergencies call 911 first.

ERs are the best place for treating severe and life-threatening conditions. Specialist Urgent Care ER COPAYS. Blue Cross and Blue Shield of Texas BCBSTX the leader in health insurance presents a free guide to saving money.

A trip to the ER could be as much as a 200 copay. For example copays are usually higher when you go to the hospital than when you go to your doctors office. The amount of your copay may vary based on factors such as where you receive care.

Starting in July health insurance provider Blue Cross Blue Shield will stop covering emergency room visits it deems unnecessary. ER accidental injury 175 per day per facility ER medical emergency 175 per day per facility Lab work such as blood tests 0 copay 1. They have the widest range of services for emergency after-hours care including diagnostic tests and access to specialists.

Emergency room care 300 copayment 300 copayment None Emergency medical transportation 20 coinsurance 20 coinsurance None If you need immediate medical attention Urgent care 50 copayment 50 copayment None Facility fee eg hospital room 20 coinsurance 50 coinsurance-Prior authorization may be required or services will not be. When to seek ER care. There are two times you may not have a copay.

EPO Plan 25 40 40 250 copay plus 20 coinsurance COPAYS. If you feel your condition doesnt require the emergency room call your personal physician or go to a walk-in clinic or urgent care center. A copay or copayment is a set amount that you pay at the time and place of service.

Copayments are usually due at the time you have an office visit or fill a prescription. Diagnostic services such as sleep studies CT scans Up to 100 in an office 1.

/invisalign-and-dental-insurance-coverage-7565b48f924b43c7b9f7f7431be4dcbe.png)