You qualify for subsidies if pay more than 85 of your household income toward health insurance. The American Rescue Plan removes the income cap for two years for health insurance premium tax credits through the federal health exchange or a state marketplace.

Obamacare Income Limits 2018 Income Calculations Obamacare Quotes

Obamacare Income Limits 2018 Income Calculations Obamacare Quotes

Reducing the monthly cost of health insurance for the eligible individual.

What are the income limits for marketplace insurance. For a single person in 2021 thats 51040. For 2020 coverage those making between 12490-49960 as an individual or 25750-103000 as a family of 4 qualify for ObamaCare. For 2021 those making between 12760-51040 as an individual or 26200-104800 as a family of 4 qualify.

In 17 million more people getting insurance through the marketplace. And although there is normally an income cap of 400 of the poverty level discussed in more detail below that does not apply in 2021 or 2022. How do I know what to enter for my income.

When consumers enroll they can choose a plan that is the same costs more or costs less than the benchmark plan. Some consumers making more than 400 FPL may not receive tax credits if the cost of the benchmark plan is less than the 85 of their household income that they need to contribute toward the premium. If you already enrolled in an ACA plan and got a subsidy you can change your plan and get the added savings.

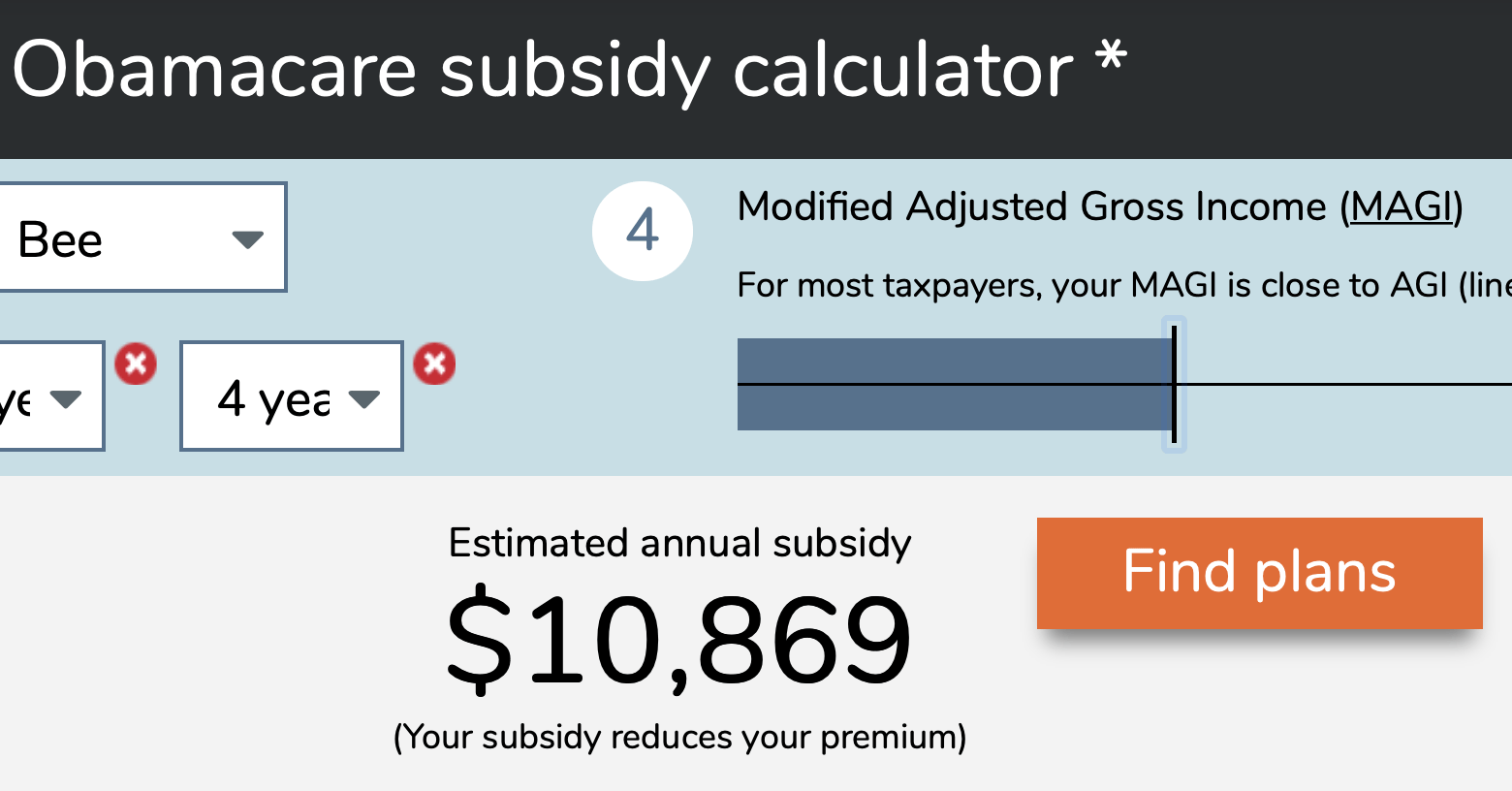

The Health Insurance Marketplace Calculator allows you to enter household income in terms of 20 21 dollars or as a percent of the Federal poverty level. 58000 in income about 450 of the 2021 poverty level of 12880. And even for people whose income stayed under 400 percent of the poverty level there was the possibility of having to repay as much as 2700 in excess premium subsidies depending on the actual income and tax filing status.

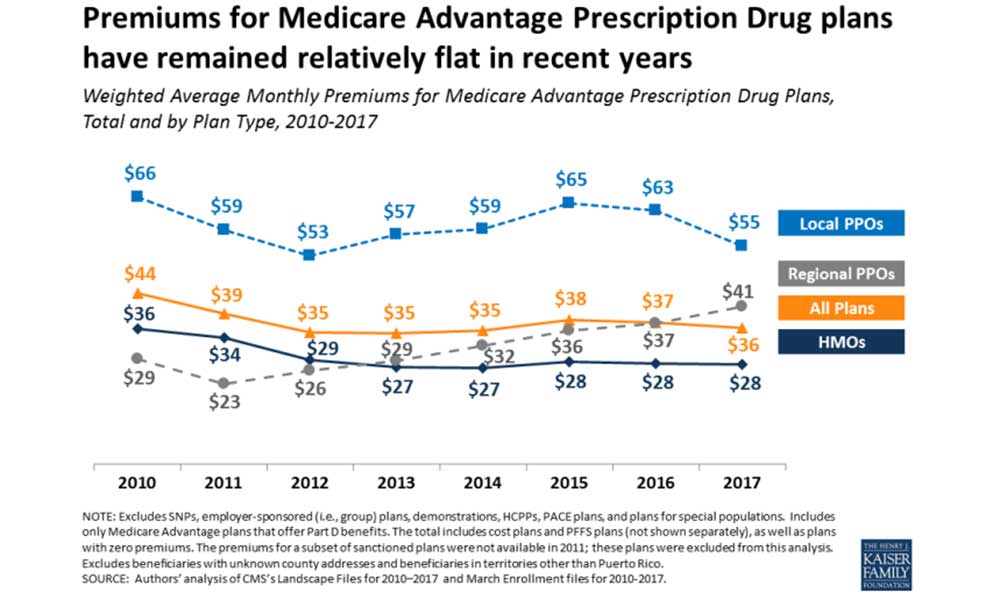

Premiums will drop on average about 50 per person per month or 85 per policy per month. Subsidies are available to individuals and families with income between 100 to 400 of the FPL chart below. Any household with income at or above 200 of the federal poverty level FPL is potentially eligible for a tax credit but there is an income amount at which the tax credit will be 0.

Provision applies only to the 2020 tax year. 983 and boosts subsidies to lower-income consumersthose with incomes between 100 and. Income is above 200 24280 for an individual of the Federal Poverty Level you are likely eligible to enroll in a Qualified Health Plan.

You will need to complete an application to determine your actual eligibility. 9 rijen 2021 Federal Poverty Level FPL Guidelines. For coverage in 2021 the subsidy amount is based on.

The Affordable Care Act Obamacare is a way to help lower-income individuals and individuals without health care afford health care. Im a supporter of ACA despite the. 20 rijen Marketplace savings are based on your expected household income for the year you.

For 2022 coverage see our page on the maximum income for ObamaCare for 2021 -. For a family of four its 104800 these limits are for the continental US. 2021 Key Subsidy Information.

This article will look at the subsidy amounts by income for the the Affordable Care Act. You can use this tool from the Health Insurance Marketplace to see if you might qualify for Medicaid in your state. Most consumers under the age of 65 can enroll in a Qualified Health Plan on the Marketplace and depending on income may be eligible for a tax credits that could help lower the cost of coverage.

Income limits are higher in Alaska and Hawaii for all programs. They are higher in Alaska and Hawaii where the federal poverty level amounts are higher. It also limits the maximum amount anyone must pay for marketplace health insurance to 85 of income vs.

Although health care is still extremely expensive the Affordable Care Act provides subsidies. For income-based subsidy eligibility a household must have an income of at least 100 of the federal poverty level 139 percent of the federal poverty level in states that have expanded Medicaid. The amount you pay.

It also would limit the amount paid in. In 2021 the American Rescue Plan temporarily allowed all households who purchase insurance through the marketplace to qualify for subsidized health insurance even if their income exceeds 400 of the federal poverty level. These income guidelines are approximate and for informational use only.

The approved subsidy amount will provide a direct and immediate offset. Premium subsidies in the health insurance exchange are only available if your MAGI doesnt exceed 400 of the poverty level.