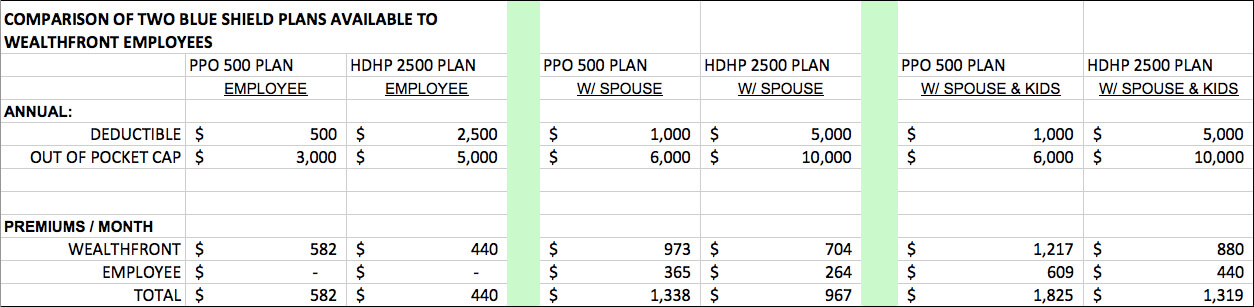

In addition the plans out-of-pocket limit must be no higher than 7000 for an. A preferred provider organization plan gives you access to a network of healthcare providers and medical facilities at reduced pricesgenerally.

Think Carefully Before Signing Up For A High Deductible Health Plan

Think Carefully Before Signing Up For A High Deductible Health Plan

1 Per IRS guidelines in 2021 an HDHP is a health insurance plan with a deductible of at least 1400 if you have an individual plan or a deductible of at least 2800 if you have a family plan.

What is a hdhp ppo plan. Youll be expected to pay a higher deductible than you would with a PPO or HMO but the amount that comes out of your paycheck each month is generally much lower. A High Deductible Health Plan HDHP is a healthcare plan traditionally defined by lower premiums and higher deductibles. Employers often pair HDHPs with a Health Savings Account HSA funded to cover some or all of your deductible.

Having a high deductible provides an advantage to the health care consumer by reducing their monthly premium for ongoing coverage. A High Deductible Health Plan HDHP has low premiums but higher immediate out-of-pocket costs. What Is a High-Deductible Health Plan HDHP.

If you decide to go with the HDHP plan to open a Health Savings Account HSA. The PPO network means that participants have both in-network and out-of-network benefits but dont have to designate a PCP or get referrals to see specialists. A high-deductible health plan HDHP is a form of health insurance that offers a higher deductible than other forms of traditional health insurance.

Sometimes referred to as a catastrophic health insurance plan an HDHP is an inexpensive health insurance plan that generally doesnt pay for the first several thousand dollars of health care expenses ie your deductible but will generally cover you after that. The deductible is the amount youll pay out of pocket for medical expenses before your insurance pays anything. A high-deductible healthcare plan HDHP is one where you have high deductibles and out-of-pocket maximums but lower premiums than traditional plans.

In 2019 the IRS states that an HDHP must have a minimum deductible of 1350 a year and an out-of-pocket maximum of 6750 for individuals. Still PPOs stand out for flexibility and access. HDHPs or High Deductible Health Plans Like the name says this type of plans deductible is higher than most traditional plans.

2019 HDHP Requirements Annual minimum deductible of 1350 for individuals and 2700 for families Annual out-of-pocket maximum cant be more than 6750 for individuals and 13500 for families. What Is a PPO. A deductible is the portion of an.

The easiest way to understands HDHPs is to compare them to your auto insurance. HDHP stands for high deductible health plan. This triple tax-free account allows you to enjoy the following benefits and options to pay for your medical bills.

Just like the name sounds each plan has a high deductible that must be met first before your insurance kicks in. The Consumer Directed HealthSelect SM plan is a high-deductible health plan HDHP with a health savings account HSA and PPO network. HDHP High-Deductible Health Plan The definition of the high-deductible health plan HDHP is in the name.

But in fact PPO out-of-pocket costs can climb quite high depending on the insurance company youre working with. To qualify as an HDHP the IRS says a plan must have a deductible of at least 1350 for an individual and 2700 for a family. These plans have a higher deducible than other health plans.

A high-deductible health plan HDHP is a health insurance plan with a high minimum deductible for medical expenses. High Deductible Health Plan HDHP High is the first word and it refers to the deductible. Deductible is the limit you have to pay before your healthcare insurance actually starts to pay.

You may also deposit pre-tax dollars in your account to cover medical expenses saving you about 30. This plan is available to people not enrolled in Medicare. The second most important benefit of using an HDHP plan is the associated tax shelter with this health care plan.