It is totally upon the organization whether to introduce the life insurance or not. Best Life Insurance Offers For You.

Group Insurance Vs Individual Life Insurance

Group Insurance Vs Individual Life Insurance

Group Term Life Insurance Meaning.

Group life insurance benefits. Optional riders andor features may incur additional costs. 3rd St Suite G-159 Baton Rouge LA 70802. Policy limitations and exclusions apply.

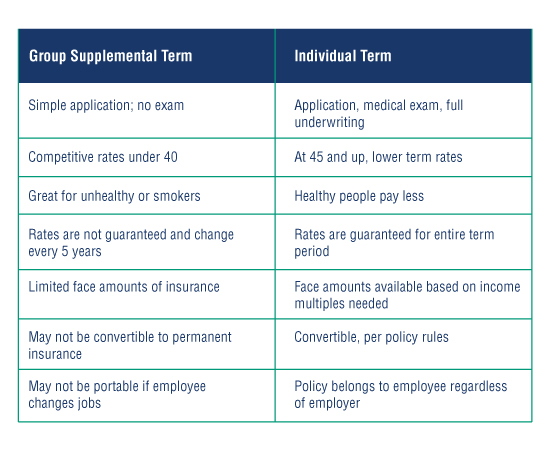

Premiums paid on group benefits can be written off as a business expense Maintain a competitive edge in the job. Plan members enrolled in life insurance coverage will automatically have a 25 percent reduction in life coverage on January 1 following their 65th birthday. The first 50000 of group.

Group life insurance products offer benefits to a group of people. Group Term Life With Living Benefits Insurance Plan Plan structured to allow benefit payments for qualifying critical health conditions in addition to the standard accelerated death benefit in the event of a terminal illness diagnosis and a death benefit. Life Auto Home Health Business Renter Disability Commercial Auto Long Term Care Annuity.

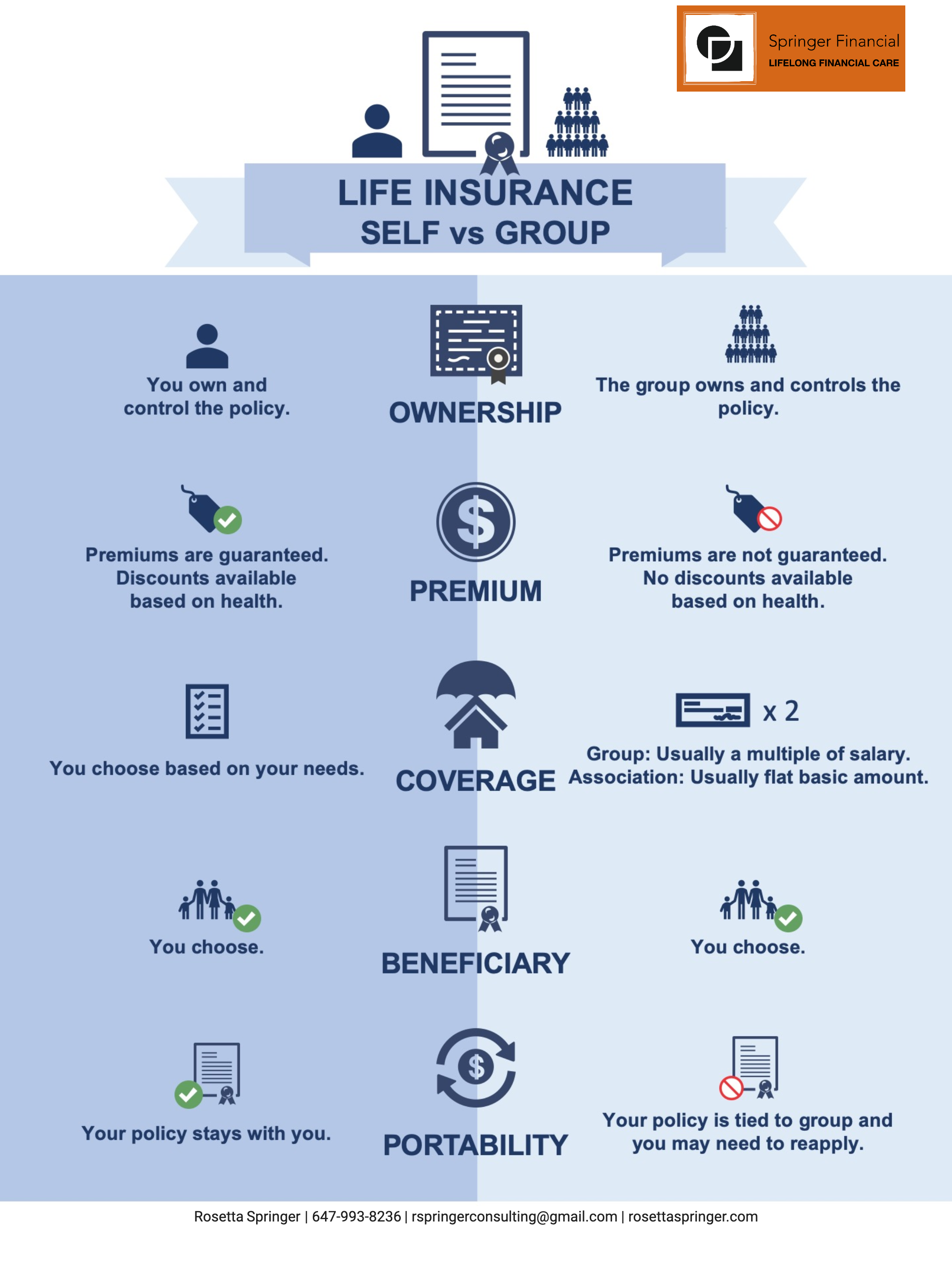

Group policies are affordable and the cost of insurance is much lesser than for an individual policy. Its main purpose it to offer benefit to employees so that families have some financial protection when an employee die. While pricing information isnt available online Aetna could be a good option if you can get a low rate through your employer.

Whole life insurance policies are permanent have higher premiums and death benefits and constitute the most popular type of life insurance. It is the one of the most important benefit that is provided by the employer to their employees. There is option for employees to purchase the insurance.

There are additional benefits associated with our life Insurance and annuity solutions provided by optional riders. Box 44036 Baton Rouge LA 70804 If you feel your Pharmacy Benefits Manager PBM has steered you to use a specific pharmacy over your chosen pharmacy call the Office of Group Benefits OGB at 1-800-272-8451 to report the issue. Group term life insurance is an employee benefit thats often provided for free by employers.

Aetna writes term policies with an appealing set of living benefits along with conversion and portability features. Consider group life insurance. Office of Group Benefits.

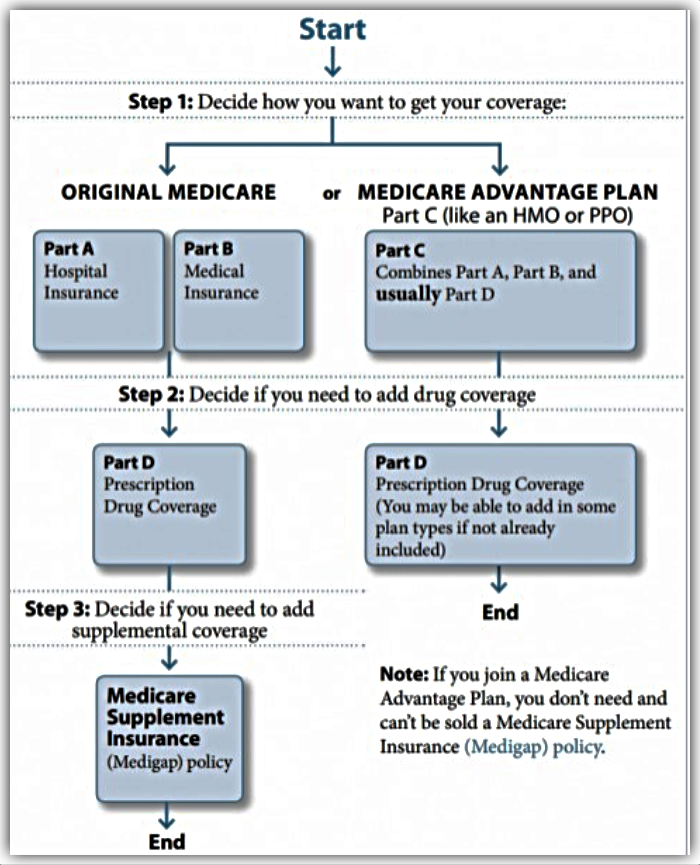

With group life insurance the employer or organization. Many employers offer life insurance as an employee benefit. With a group life insurance policy the insurance contract is between the group and the insurance company and the participating group members receive certificates of coverage.

The Basic Group Term Life Insurance Program is a state-paid benefit provided for managerial supervisory confidential and other specified excluded employees. Aetna only offers group life insurance coverage through employers so individuals will not be able to get a quote or apply for a policy online. You can opt in without the insurer checking your.

Eligible employees may apply for supplemental coverage for themselves as well as dependent coverage for their spouse registered domestic partner andor eligible children. The insurance cover will be provided to a group of people under a single master life insurance policy. Employees may also have the option to buy additional coverage through payroll deductions.

We call them Living Benefits and we have been providing them since 1937. Guardians Group Long Term and Short Term Disability Insurance is underwritten and issued by The Guardian Life Insurance Company of America New York NY. Products are not available in all states.

Check Help your employees be financially prepared for events that could change their lives. Protect the health financial well-being of your employees and yourself with group insurance plans from Nationwide Employee Benefits. Premium rates will be reduced accordingly.

Another automatic 25 percent reduction in coverage will take effect on January 1 following their 70th birthday. Call 1-888-674-0385 to get started. Group Insurance Our Group Insurance Benefits help you your employees and their beneficiaries by reducing the financial impact of unexpected life-changing events that could leave them without an income because of critical illness disability or death.

Sometimes you dont even have to pay the premiums. Group life insurance is a benefit offered by groups to their members -- most commonly by employers to their workers. Benefits for your company Help improve morale and increase productivity Can be less expensive than providing salary increases as there are no additional increases in CPP EI or Workers.

Based on the product living benefits can provide benefits should a qualifying terminal chronic or critical illness or critical injury occur 1 or if your desire is to have an income that you cannot. Group Life Insurance Death Benefits May 2021.