COBRA coverage must be equivalent to what was offered under the employers plan. If you sign up for COBRA continuation coverage you can switch to a Marketplace on or off-exchange plan during a Marketplace open enrollment period.

How Do I Enroll In Cobra Online

COBRA allows for the families of deceased employees to use the insurance for 36 months.

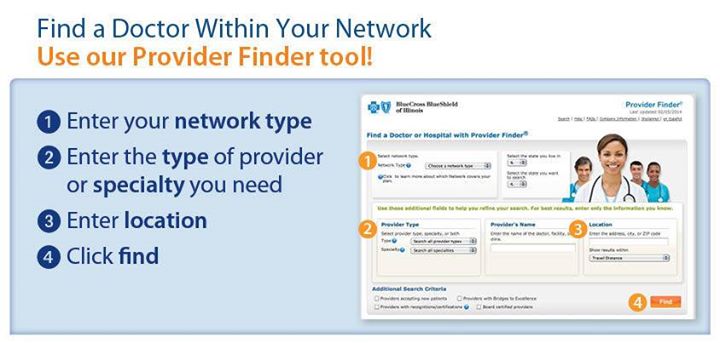

Can you sign up for cobra online. If your group health plan coverage was from a state or local government employer call the Centers for Medicare Medicaid Services CMS at 1-877-267-2323 extension 61565. Until May 15 you can sign up for an Affordable Care Act-compliant health plan. One advantage of enrolling right away is that you can keep seeing doctors and filling.

If you qualify you should get a written notice of your eligibility for COBRA. COBRA requires employers to keep you. All enrolled COBRA participants are required to return a completed COBRA Open Enrollment Form regardless of whether or not any changes are being made.

Call the Help Center if you. If you need health coverage in the time between losing your job-based coverage and beginning coverage through the Marketplace for example if you or a family member needs medical care you may wish to elect COBRA coverage from your former employers plan. If your coverage was with the federal government visit the Office of Personnel Management.

To sign up for COBRA it may be necessary for you to first give notice to the employer of the qualifying event. Once signed up for COBRA youll use your health insurance plan like you did when employed. But keep in mind that delaying enrollment wont save you money.

Consider several factors before deciding whether or not to elect COBRA coverage starting with the cost. What happens if someone fails to notify their plan that. However if the qualifying event is a divorce or the age-out of a dependent child the employer may be unaware and will need to be.

Generally premium assistance means that youll have a 0 monthly premium. When you sign up for COBRA insurance always make a note of any special requirements your policy may have for cancellation as many times you will have to notify your previous employer in writing. The applicant person requesting review of a denial of premium assistance may either be the former employee or a member of the employees family who is eligible for COBRA continuation coverage or the COBRA premium assistance through an employment-based health plan.

In some cases you can have a COBRA plan for even longer -- up. You can sign up for COBRA coverage or decline coverage. During the groups Open Enrollment period you will have the opportunity to make adjustments to your COBRA coverage.

After your policy is canceled you will receive a letter of termination and a certificate of credible coverage. For example if the qualifying event is the termination or death of the employee the employer clearly already has notice. The employee and his or her family members may each elect to continue health coverage under COBRA.

Who Qualifies and How to Sign Up The American Rescue Plan will give many recently laid off workers free insurance from April to September. You can also end your COBRA continuation coverage early and switch to a Marketplace plan if you have another qualifying event such as marriage or birth of a child through something called a special enrollment period. If you are eligible for Cal-COBRA and did not get a notice contact your health plan.

If youre eligible for COBRA because of a reduction in the hours you work or you involuntarily lost your job you may qualify for help paying for your COBRA premiums called premium assistance from April 1 2021 through September 30 2021 under the American Rescue Plan Act of 2021 based on how long your COBRA coverage can last. You have 60 days to make that decision. You can use COBRA for up to 18 months.

The last page of the notice includes the form you should use to notify your plan that youre no longer eligible for the COBRA subsidy. Open enrollment period anyone can enroll in Marketplace coverage. Youll have 60 days to enroll in COBRA or another health plan once your benefits end.

One option is signing up for COBRA which allows you to keep your previous health coverage for up to 18 months by paying both the employees and employers portions but retaining group rates. You have 60 days after being notified to sign up. With this extension of the time frame to sign for up for COBRA coverage people have at least 120 days to decide whether they want to elect COBRA and possibly longer depending on when they were.

Apply at your local or county social services agency or Call your state TANF office for your local contact information. However youll pay all of the costs with no help from your former employer. The new law offers increased subsidies for those plans reducing costs for many who buy them.

Reasons to Not Pay for COBRA. COBRA is always retroactive to the day after your previous coverage ends and youll need to pay your premiums for that period too. You can also add or remove dependents from your coverage.

To sign-up for temporary benefits you can. Free Cobra Health Insurance. If you are eligible for Federal COBRA and did not get a notice contact your employer.

Department of Labor Web site provides a model notice DOC for employers and plans to advise individuals of their right to the subsidized COBRA continuation coverage. If any of the carriers or benefit plans have changed or if you will be adding or deleting dependents you. If you miss the deadline you may lose the chance to sign up for Federal COBRA or Cal-COBRA.

You can keep COBRA for at least 18 months. COBRA continuation coverage will ensure you.