Health care costs can be controlled or decreased only by using strategies that decrease the following. A Guide to Strategic Cost Transformation in Hospitals and Health Systems 5 Eight action items can help hospital and health system executives and boards define the business strategies appropriate to their organizations and the plan by which those strate.

Cost Containment Strategies And Their Relationship To Quality Of Care Within The South African Private Healthcare Industry Semantic Scholar

Cost Containment Strategies And Their Relationship To Quality Of Care Within The South African Private Healthcare Industry Semantic Scholar

In the final step the project team estimates the total cost of treating a patient by simply multiplying the capacity cost rates including associated support.

Cost control strategies for healthcare. Negotiate with the supplier to lower the price of surgical implants. A search for cost-containment policies in general and a specific search for individual policies that were identified as cost-containment policies 13. 11 Strategies to Help You Reduce Your Health Care Costs 1.

We then present public policy options to control health care costs generated by each of these key drivers. Consumerism -It isnt about whether you should enable your employees to be smarter health care consumers but when youll position them to make better informed decisions that bring down the total cost of the benefits. With the multi-year strategic approach as your guidepost an easy way to think about it is the three Cs of cost savings.

A cost controls system and scheduling system will output different codes of information which must then be consolidated and pulled together without room for error. A twofold strategy was employed. Incentives for Comparison Shopping.

The final search string see Appendix A was amended with database specific glossary terms MeSH terms. Besides healthcare cost control hospital executives are also focusing on other cost reduction strategies. How much people use health care services How much providers are reimbursed for services How much the overhead of running a health care business is overhead excludes the costs of providing health care.

However the typical solution is a manual one which is tedious time consuming and prone to error from a multitude of sources. Another hospital cost reduction idea is to consider evaluating high-cost pharmaceuticals against generic or less expensive drugs. Five Solutions to Controlling Healthcares Cost Problem The Role of Operating Expenses in the Healthcare Cost Problem.

While the cost problems appear to be out of control and worsening healthcare. Other common techniques included dependent eligibility audits 43 percent four coverage tiers 40 percent price transparencycomparison tools 38 percent health care claims audits 37. Authors noted that a true pathway toward healthcare cost reduction will require a blend of several strategies to address the 16 factors.

Consumer Price Insensitivity Medical Errors and Inefficiency Medical Malpractice and Defensive Medicine Higher Prices and Administrative Costs. The second top area of extreme interest for hospital and health system executives was innovative approaches to expense reduction Fifty-two percent of survey respondents said they were extremely interested in this area in 2018. A major yet straightforward way to decrease your companys health care costs is.

Johnson Johnsons Health and Wellness Program has demonstrated a long term impact on controlling health care costs medical costs decreased by approximately 225 per participating employee per year during a four year study through its policy environmental and education components for addressing risks that lead to high blood pressure and cholesterol 5. The key policy options most likely to achieve the greatest cost savings are those that. A single hip joint can be in the tens of thousands of dollarsso savings in this area can be significant.

Strategies for Managing Health-Care Costs Governments need to closely monitor health-care costs and choose approaches that make use of the jurisdictions purchasing power share costs appropriately encourage good consumer behavior promote health and support governmental jurisdictions ability to hire and retain a highly qualified and motivated workforce. A path that needs to be planned out in. Healthcare providers hospitals and clinics may have.

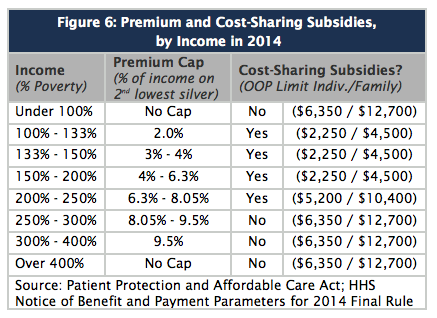

Five Ways to Control Operating Expenses. Utilization of low-value and wasteful health care services. Use of high-deductible health plans HDHPs Consumer-facing price and quality transparency tools.

The final method your business can use to lower health care costs is to educate your employees.