The savings in the hike to 2500 probably may or may not be worth the risk of paying 2500 out of pocket for repairs. You may have a required deductible amount if you have a loan or are leasing your vehicle.

How Does A Car Insurance Deductible Work Insurancequotes

How Does A Car Insurance Deductible Work Insurancequotes

If you only want the insurance to protect you from MAJOR disasters that dont usually happen in your.

Difference between 500 and 1000 deductible. A low deductible of 500 means your insurance company is covering you for 4500. The Insurance Information Institute calculates that raising your deductible from 200 to 500 can reduce your premiums by 15 to 30 percent. Same goes for 500 verse 100 deductible.

Insurance companies give drivers different deductible amounts to choose from and most options fall between 100 and 2000. If you have a 500 deductible and file a claim with your insurance company your insurer would pay the remaining 2500. This makes it a great way to save on your insurance bill if you can afford it.

Deductible amounts typically range from 500 to 1500 for an individual and 1000 to 3000 for families but can be even higher. I personally have it at 500 since the difference wasnt as much in the premiums. Well talk about health plans with high deductibles later When a family has coverage under one health plan there is an individual deductible for each family member and family deductible that applies to everyone.

To go up to 1000 deductible the homeowner saves about 10 in premiums but saves only 2 with an increase to a 2500 deductible. For example the family deductible might be 2000 and each individual deductible. Namely a deductible doesnt apply to your liability insurance.

Lets discuss the standard policy deductible. How much is the difference is where the answer lies. To be honest if you have 1000 with you that you can spend guilt free if something happens to your car then might be worth it to bump it up.

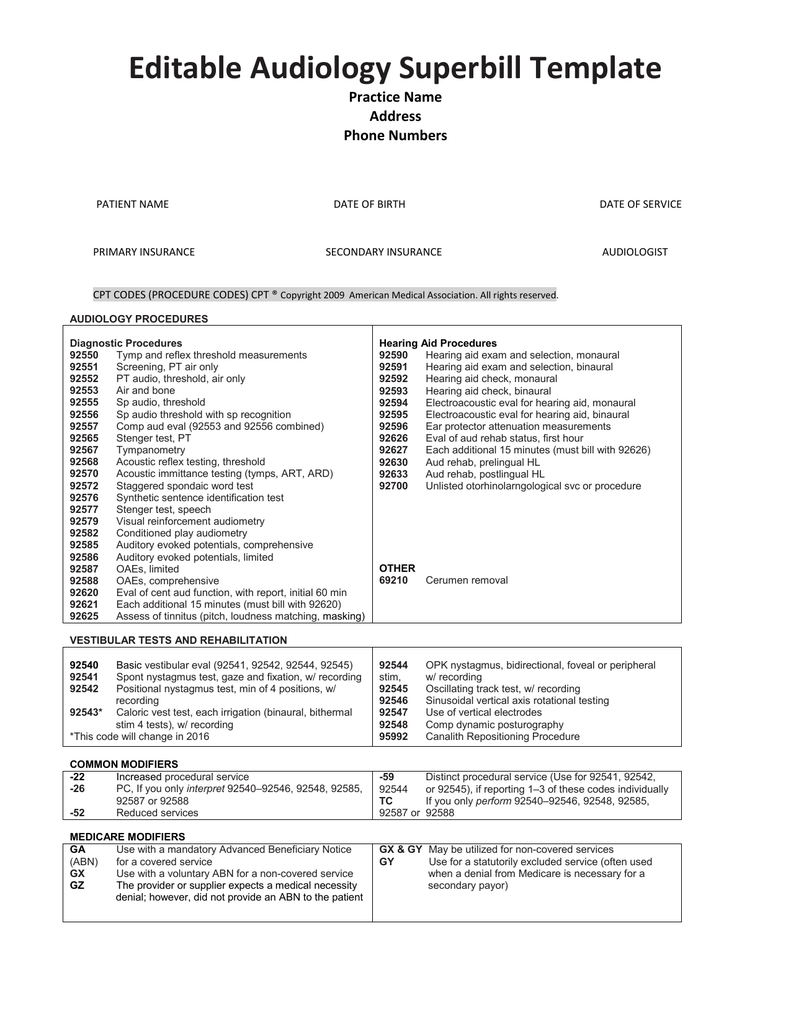

Deductible Monthly Rate Cost Difference. Normal options for policy deductibles are 500 1000 2500 and sometimes 5000 when we are speaking about homes valued under 1 million in reconstruction value. A deductible however only applies to specific insurance coverage options.

If you plan on having a lot of claims against the insurance 500 deductible is a better deal. Many people choose a 500 car insurance deductible and companies. Does my auto lease require a certain deductible amount.

Every deductible offers a percentage discount off the base premium of your insurance policy. A higher deductible of 1000 means your company would then be covering you for only 4000. The most common auto insurance deductible levels.

On average insurance companies use 500 as the base deductible. According to the Insurance Information Institute increasing your deductible from 200 to 500 can make you eligible for a 15- to 30-percent premium discount while raising the deductible to 1000 can save you up to 40 percent. You need to meet these thresholds before the insurance company will pay for certain costs.

Insuramatch Insurance Quotes and Coverage Options. Since a lower deductible equates to more coverage youll have to pay more in your monthly premiums to balance out this increased coverage. For example if your 10-year-old vehicle still has comprehensive coverage you probably dont want to carry a 1000 deductible because the value of the vehicle is likely within a couple thousand dollars of the deductible.

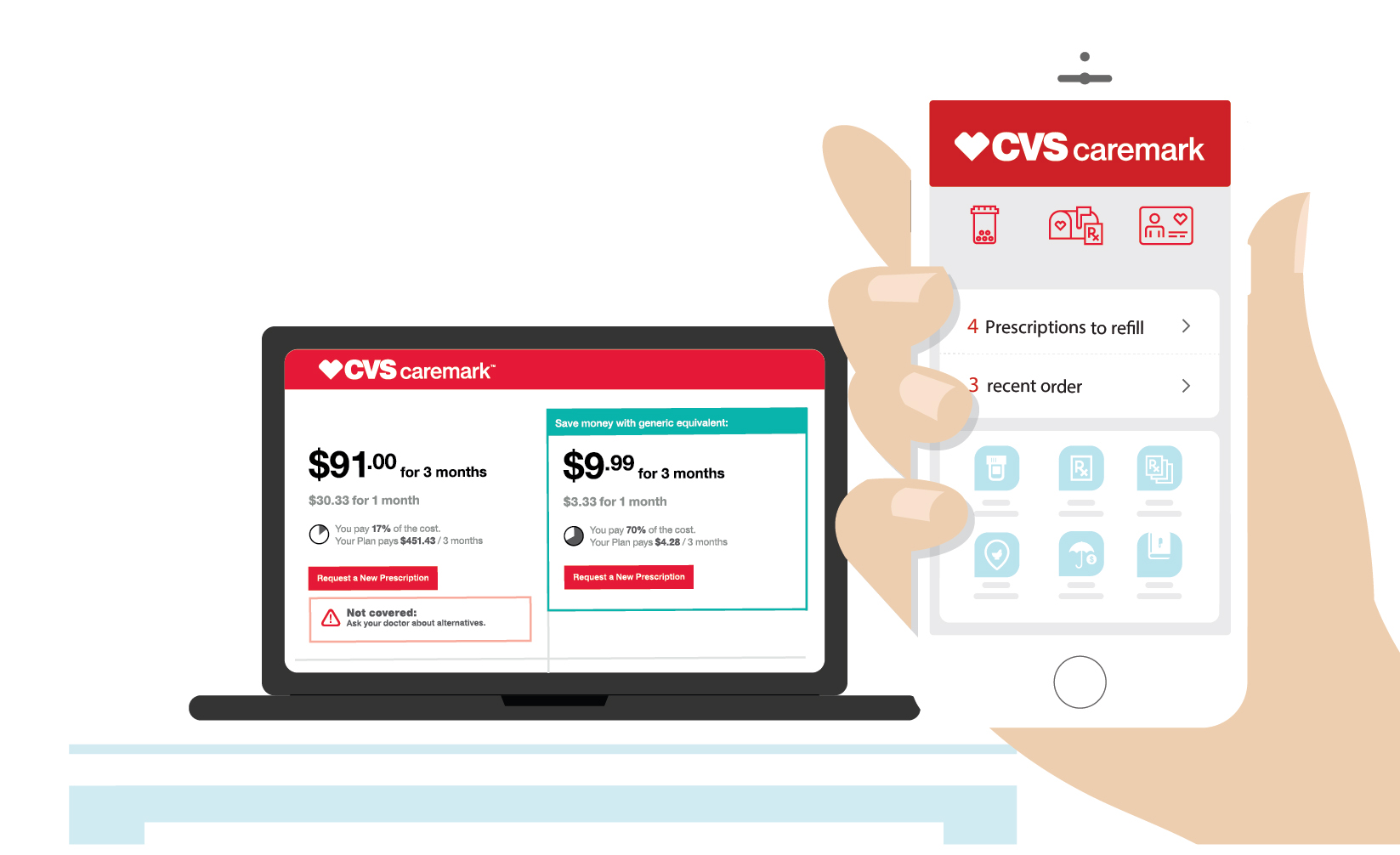

Services performed at Preferred Hospitals or at a free-standing facility unaffiliated with a hospital are covered at 90 after deductible by the Texas Health Aetna Select Plan 1000 and the UHC Choice 500 and Choice 1000 plans while care at non-Preferred hospitals is only covered at 30 after the deductible. Plus the savings of a 1000 deductible verse a 500 deductible on comprehensive may only be a few dollars every month. Some lease agreements require low deductibles of 500.

A thousand-dollar deductible can save you 372 a year on your premium compared to a 500 deductible. 53 rows The portions of a policy that carry a deductible are two optional. When you see a health insurance plan with a 5001500 deductible that means that the deductible for each covered individual on your plan is 500 and that the total family deductible is 1500.