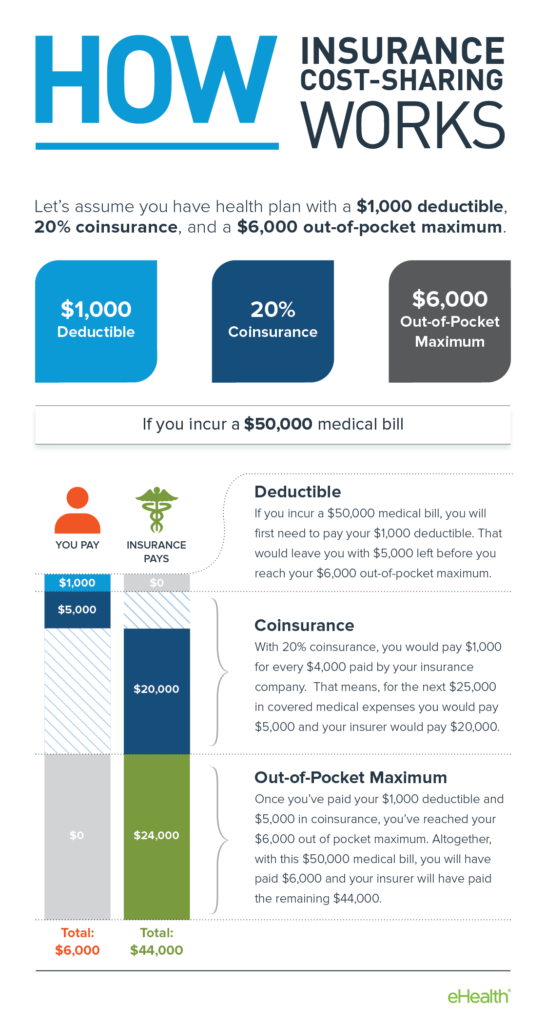

As soon as you sign off on your health insurance plan youll begin paying monthly premiums. The main difference between copay and deductible is that until the deductible is paid in full the insurance company does not contribute towards the medical bill.

Definitions And Meanings Of Health Care And Health Insurance Terms

Definitions And Meanings Of Health Care And Health Insurance Terms

Copay - Not the Same.

Health insurance deductible vs copay. But a few insurance plans also implement copayment and deductible clauses simultaneously. Then when you go to the doctor or pick up a prescription you pay a fixed cost called a co-pay and the insurance company generally covers the rest. Co-pay plans will usually have a co-insurance the cost sharing with the health insurance company on higher ticket services like hospital stays maternity care x-rays etc.

In this case youd pay 1200 for the MRI on top of the 30 copay. Of the remaining 1800 you pay 360 your 20 coinsurance while your provider pays the leftover 1440. A copay is a common form of cost-sharing under most insurance plans.

A deductible is the amount you have to pay for covered services before the health insurance company will help chip in with the cost. Your deductible is 1000 and your coinsurance responsibility is 20. On a traditional co-pay plan you and your employer pay a monthly premium to cover the cost of your health insurance.

The copay percentage can vary between 5-20 and depends on the insurance company and the health insurance policy that you are opting for. Furthermore a deductible is paid only a few times a year until the total deductible is met whereas copay is made every time a prescription is filled or when the patient visits a healthcare practitioner. Your plan may have a 0 copay for seeing your doctor for example in which case you would not have to pay a copay each time you visit your doctor.

X-rays average between 200-500 for patients with insurance so unless your labstesting are less than 60 youd be better off with the 25 flat copay. How health insurance cost sharing works together All health insurance plans have a premium deductible and out-of-pocket maximum and yours might have a copay and coinsurance too. Your remaining deductible is now 0 and your OOP max.

Generally heres how cost sharing works if you stay in network. With the deductible covered you now only owe a 20 coinsurance for the rest of the bill. A deductible is the amount you pay for most eligible medical services or medications before your health plan begins to share in the cost of covered services.

If your plan includes copays you pay the copay flat fee at the time of service at the pharmacy or doctors office for example. If its only 6 Id concede to your point but youll be very very hard pressed to find facilities that negotiate the majority of labsdiagnostic testing below 60. Copays are a fixed fee you pay when you receive covered care such as an office visit or pick up prescription drugs.

What is a deductible. Co-insurance percentages often differ across services like a hospitalization versus a prescription fill. There could be a deductible on medical services or.

Depending on how your plan works what you pay in copays may count toward meeting your deductible. Co-insurance is often presented as a percentage. Copays and deductibles are both out-of-pocket payments you can expect to make with any type of health insurance.

Co-pay plans also have a deductible. In that case youd pay the 1000 for the deductible portion and youd also be on the hook for the remaining 20 with the health plan picking up the other 80. Co-pays usually do not.

Its important to check all details of the plan to get the specifics. A copay is a fixed amount paid by a patient for receiving a particular health care service with the remaining balance covered by the persons insurance company. While copay deductible and coinsurance are cost-sharing terms their applicability can make a huge difference to your overall health insurance plan.

If your plan includes copays you pay the copay flat fee at the time of service at the pharmacy or doctors office for example. A deductible is the amount you pay for a service before the plan shares the cost of the service with you. Co-pay plans will still have a deductible in some cases it will be 0 and out-of-pocket maximum.

Both voluntary deductible and copay are different terms. You may not always have a copay however. Deductibles and coinsurance are clauses that are mostly implemented together under one single insurance plan.

A deductible is a fixed amount a patient must pay during a given time period usually the plan year before their health insurance benefits begin to cover the costs. After you meet your deductible if your co-insurance is 20 youre responsible for 20 of the cost while your plan pays the remaining 80.

/GettyImages-488335473-56fb22633df78c7841a13e95.jpg)