Customer Service at 1-800-228-6080 E-mail. In 1973 Medico Insurance.

Medicos Dental Vision Hearing Product Dvh Plus Medico

Medicos Dental Vision Hearing Product Dvh Plus Medico

For PPO contract information call the Dentist Contracting Hotline at 1-800-776-0537.

Medico dental insurance phone number. Thank you for taking the time to view our dental plans. By choosing one of our dental insurance plans you will also receive a 25 no claims discount upon joining and have worldwide cover for dental accidents and dental emergencies. Medico Insurance Company Locations.

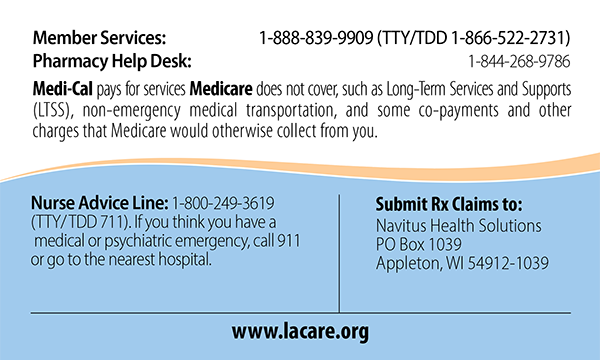

23160 All other claims can be submitted to the Medico Insurance Company by mail or by fax. Call the National Dentist Line at 1-800-451-7715. The MetLife Exclusive Provider Organization EPO contains features similar to PDP DHMO.

Here youll find forms to process claims update information provide authorizations and more. If you have questions please contact your agent RYAN FOWLER at 319826-6874 If you have questions please contact your agent RYAN FOWLER at. Toll free phone number.

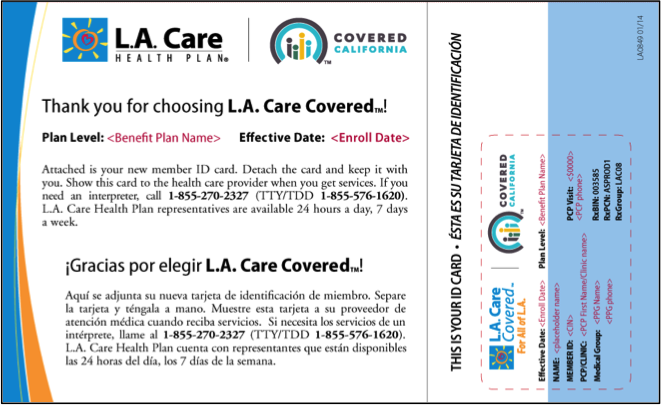

However you do not need to select a primary care dentist. Available in CA FL NJ NY TX. Dental insurance policies and vision benefits rider are underwritten by Mutual of Omaha Insurance Company 3300 Mutual of Omaha Plaza Omaha NE 68175.

This communication provides a general description of certain identified insurance or non-insurance benefits provided under one or more of our health benefit plans. If you choose the 1500 or 2500 benefit you do get access to 50 vision and hearing coverage after 12 months. Coverage may not be available in all states and may vary by state.

Get a quote online Call us on 0800 171 2055 Terms conditions apply. DO NOT MAKE CHECK PAYABLE TO THE PRODUCER OR LEAVE THE PAYEE BLANK. Contact Agent Services at 800 547-2401 Option 3.

Dental policy forms DNT2 and DNT5. 1-800-228-6080 Human resource department. If you do not receive your contract within 30 days please contact us by one of the following methods.

Vision benefits rider form 0PD1M. Our health benefit plans have exclusions and limitations and terms under. Direct those calls to 800-822-9993.

You will need to submit forms to allow us to perform a variety of tasks for your Medico insurance policy. Medico Insurance Company provides your Hospital Network through MedCare Advantage. If you received your Medico Agent writing number today please note that there is a 24 hour wait before you can register.

You may utilize the hospital lookup function below to find participating hospitals. Medico Insurance Company PO Box 21660 Eagan MN 55121-0660 Fax. Dental Providers should submit electronic claims by using Medico Insurance Payer ID.

Medico Dental Insurance Portfolio. Medica is a Qualified Health Plan issuer in the MNsure Health Insurance Marketplace in the North Dakota Health Insurance Marketplace and in the Wisconsin Health Insurance Marketplace. This policy provides DENTAL insurance only.

Provider Service Center 1-800-458-5512 7 am. The company introduced their first product for seniors in 1959 which was seven years before Medicare started. Our Customer Care representatives are available 730 am.

Call us toll-free at 800-228-6080 for all policies except those written under Medico Corp Life Insurance Company. If a form you need is not listed below contact Customer Care at 800-228-6080. MUST BE MADE PAYABLE TO MEDICO INSURANCE COMPANY.

1-402-496-8199 Medico is a servicemark owned and licensed by Medico Insurance Company. Humana group life plans are offered by Humana Insurance Company or Humana Insurance Company of Kentucky. Life Insurance Plans.

Medico Insurance is based out of Omaha Nebraska. Medicos base dental plan only covers dental not vision or hearing. Medica does not discriminate on the basis of race color national origin disability age sex gender identity sexual orientation or health status in the administration of the plan including enrollment and benefit.

Medico Insurance Company PO Box 10386 Des Moines IA 50306 Call. You must see an in-network EPO provider to utilize dental benefits. For costs and further details of the coverage including.

To 5 pm Monday Friday Closed Mondays from 8 to 9 am. Medicos Dental Insurance offers 3 benefit options including 1000 1500 and 2500 yearly maximum benefits. Medico Insurance Company was started as an accident and health insurance company in 1930.

Medico Insurance Company History. Central time Monday through Friday.