Consequently City County of San Francisco employees have three dental plans to choose from. Annons Edit Fill eSign PDF Documents Online.

Https Www Sfhp Org Files Programs Healthy Workers Hw Sob Eng Pdf

Delta Dental PPO DeltaCare USA DHMO or UnitedHealthcare Dental DHMO.

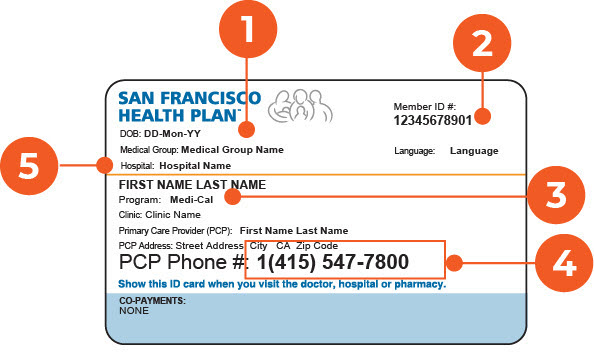

San francisco health plan coverage. Call the Medi-Cal office at 1 415 863-9892 for more information. Frames and lenses are not covered. 0 access to a virtual doctor 247 through SCANs telehealth benefit.

Vision benefits for adults age 21 years and older include eye exams from an Optometrist once every 24 months. Gastric by-pass Surgery Services. Citywide FY 2018-19 Target.

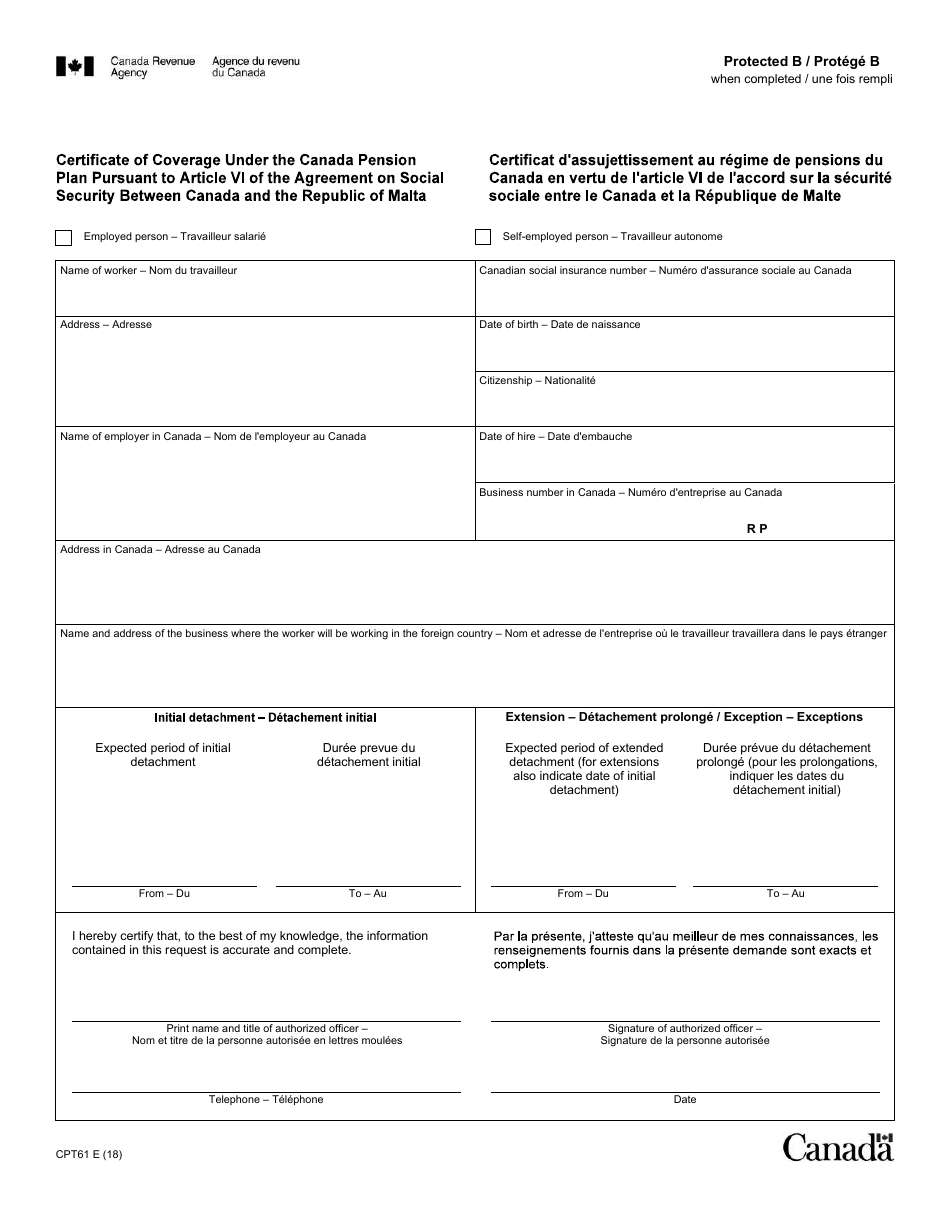

Healthy San Francisco is a limited health access program. PPO-style dental plans like Delta Dental PPO allow you to visit. If you did receive your renewal packet and have questions about how to fill out the forms call us at 1 888 558-5858 Monday through Friday 830am to 530pm or contact our Customer Service.

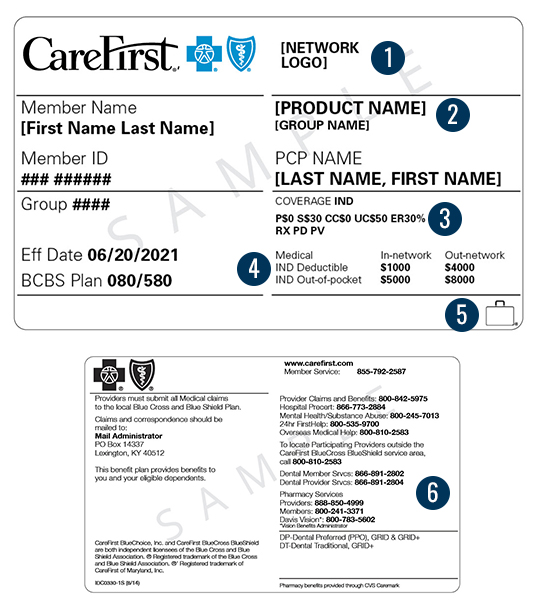

Annons Edit Fill eSign PDF Documents Online. This combined evidence of coverage and disclosure form constitutes only a summary of the health plan. 5000 Maximum out-of-pocket MOOP.

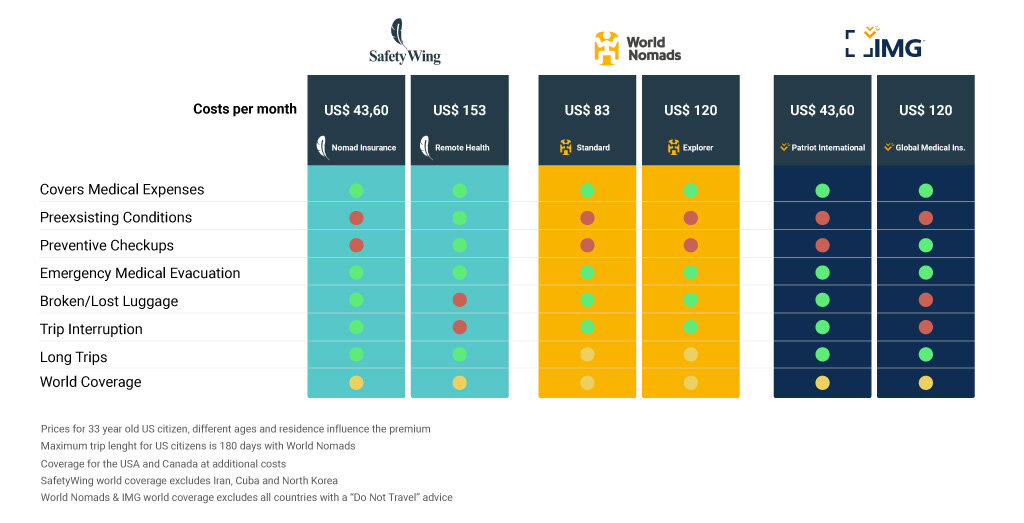

Annons Health Insurance Plans Designed for Expats Living Working in Sweden. Medi-Cal is a health insurance program for low-income residents of California. SCAN Health Plan is with you every step of the way providing comprehensive coverage thats designed to meet your current and changing needs.

The San Francisco Health Plan Evidence of Coverage and Disclosure Form should answer your questions about how to use the plan. Frames and lenses are covered. Almost every doctor or clinic that accepts Medi-Cal is part of our network so chances are you can continue to see the doctors you know and.

There are certain services that are not included in Healthy San Francisco. Understanding the HCAO Video. 24-hour care for sudden serious and unexpected illness injury or.

Annons Health and Safety Construction Plans for Contractors. Statistics on health insurance status are important for guiding insurance enrollment outreach activities and also provide public health agencies with the ability to plan for current and future health care. As a member of San Francisco Health Plan you have peace of mind knowing your family is healthy and happy.

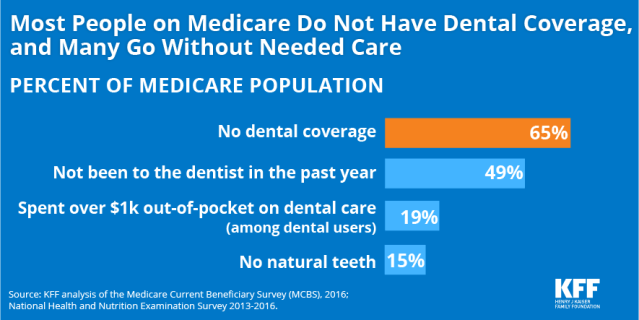

MEETING TARGET This is a measure of health insurance coverage both public and private for residents of San Francisco. SFHSS recognizes that dental benefits are a very important part of your healthcare coverage and for maintaining your good overall health. 5 primary care office visits.

The health plan contract must be consulted to determine the exact terms and conditions of coverage. As a member of San Francisco Health Plan you have peace of mind knowing your family is healthy and happy. Because of the risk that diabetes poses to vision it is important for San Francisco Health Plan members with diabetes to get their routine eye exams.

24 rader Emergency Health Coverage. Annons Health Insurance Plans Designed for Expats Living Working in Sweden. The following is only a partial list of services that are not provided by Healthy San Francisco.

Annons Health and Safety Construction Plans for Contractors. Effective July 1 2020 covered employers who make payments to San Francisco General Hospital to satisfy the requirements of the HCAO must pay 560 per hour capped at 22400 per work week. Allergy Testing.

As your local health plan San Francisco Health Plan offers an excellent and large selection of doctors hospitals and clinics. This rate is adjusted for inflation annually on July 1. We offer two unique health care coverage programs that provide complete medical dental and vision care at a very low cost.

We offer two unique health care coverage programs that provide complete medical dental and vision care at a very low cost.

/invisalign-and-dental-insurance-coverage-7565b48f924b43c7b9f7f7431be4dcbe.png)

/GettyImages-488335473-56fb22633df78c7841a13e95.jpg)